SBA Loans in 2026: How Approvals Really Work

Most SBA guides online are written by content marketers who have never seen a credit memo before. This guide reflects how SBA loans are actually approved, stalled, overridden or declined by lenders and credit committees that review thousands of files each year.

Before assuming you are ready for an SBA loan, it's really critical to understand how lenders evaluate risk behind the scenes. Borrowers who understand actual approval mechanics move through underwriting faster, face fewer surprises and avoid declines that appear to come out of nowhere.

This guide is definitely not a checklist. Think of it as a map showing you exactly how SBA loans really move through eligibility screening, underwriting and committee review in 2026.

How SBA Lending Really Works in 2026

SBA loans don't work the way most business owners think they do. The SBA does not actually lend any money directly. Banks, credit unions and non bank lenders originate loans while the SBA provides a partial guarantee. That guarantee reduces lender loss exposure and encourages banks to lend, but it also introduces strict rules, automated screening systems and layered approvals that borrowers never see.

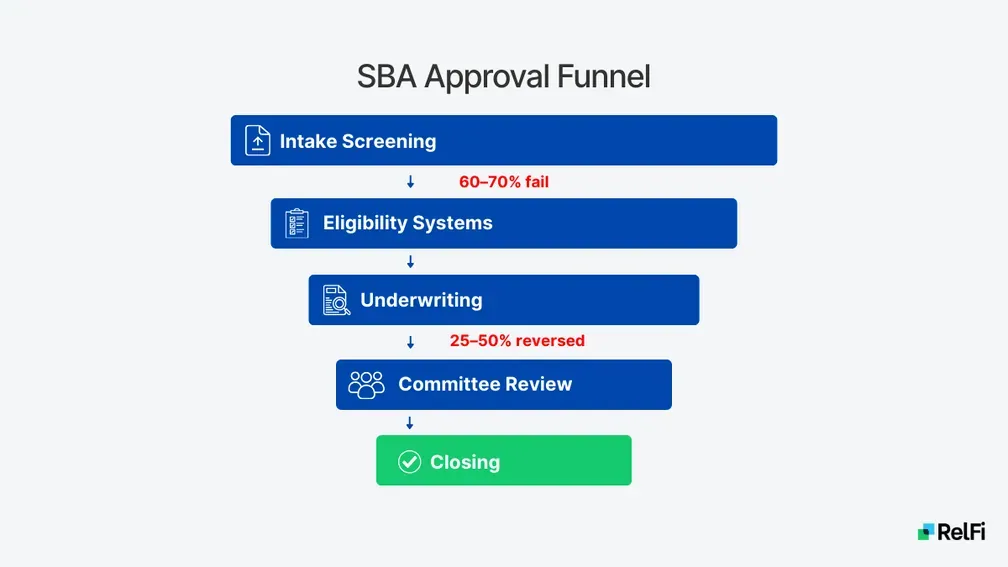

Every SBA loan moves through three distinct decision layers, each evaluating risk from a different angle. If a file fails at any point, the process stops, regardless of how strong it looks elsewhere.

Borrowers looking for an SBA loan are often surprised to learn that most files never even reach underwriting. Screening, eligibility validation, underwriting, committee review, and closing happen in sequence, and being strong in one stage of the funnel does not mean you will be strong in the others.

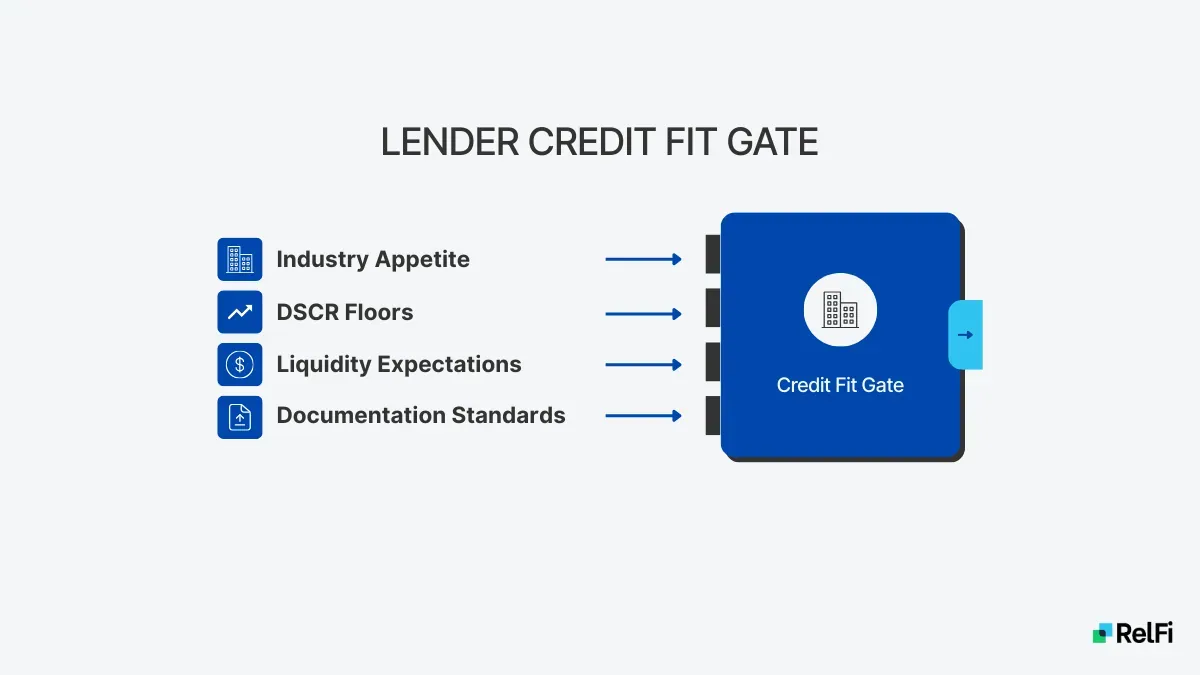

The first layer borrowers encounter is lender credit fit. This includes industry appetite, internal credit box rules, DSCR floors, liquidity expectations and documentation standards. These criteria vary widely between banks, credit unions, and non bank lenders, which is why files declined at this stage can often be approved elsewhere with the right guidance.

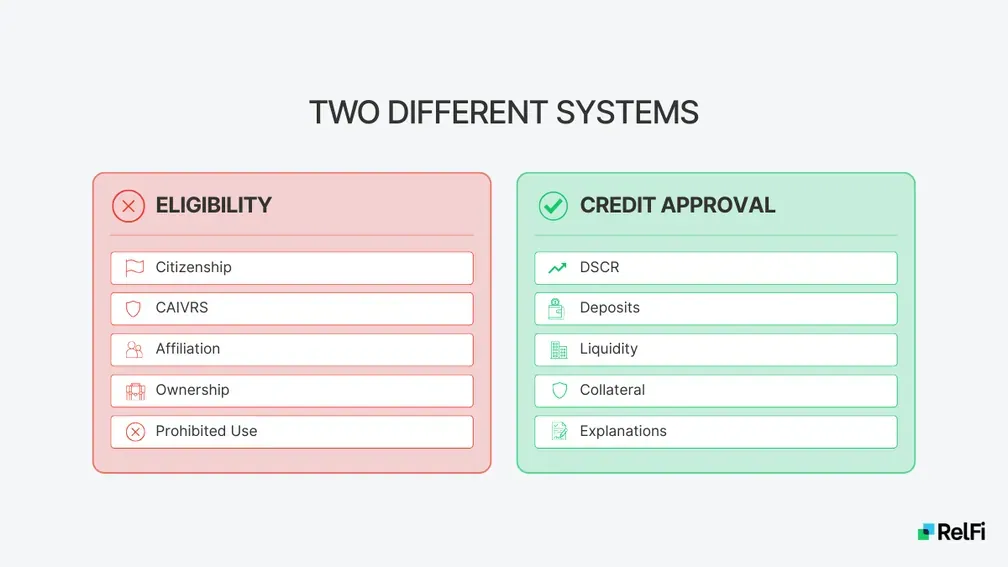

The next layer is SBA eligibility validation. This is where the file is screened for ownership structure, citizenship, prior federal debt, affiliation rules and historical SBA compliance through automated systems tied to ETRAN, CAIVRS and OFAC. These checks happen before underwriting and are not negotiable. Borrowers declined at this stage will rarely be told why.

The third layer is portfolio and secondary market influence. Most SBA lenders sell the guaranteed portion of approved loans into the secondary market, which directly affects capital allocation, industry concentration limits and pricing appetite. When secondary market premiums compress, lenders tighten credit boxes. When premiums expand, lenders compete more aggressively for volume. Secondary market sales are a major profit center for most SBA lenders and shifts in that market directly influence how willing they are to approve new deals.

A borrower can look strong to one layer and still fail another. That’s why deals often fall apart even after a term sheet is issued.

Many borrowers instinctively shop SBA loans by the lowest rate, but this is backwards. Lender selection isn’t a pricing decision, it’s an underwriting decision. Choosing a lender whose credit box fits the file matters far more than negotiating a quarter point on rate.

SBA Loan Programs and When Each One Wins

It’s common for borrowers to focus on program names without understanding how lenders actually use each option. SBA programs differ meaningfully in structure, repayment terms, collateral rules and approval behavior.

Choosing the wrong program can introduce unnecessary friction or force exceptions later in the process. Choosing the right structure improves approval odds before underwriting even begins.

SBA 7(a) Loans

The SBA 7(a) program is the most flexible and widely used SBA financing option. It supports business acquisitions, partner buyouts, working capital, leasehold improvements, equipment purchases and owner occupied commercial real estate within a single structure. When a transaction involves multiple uses of funds, 7(a) is often the only program that can accommodate everything without compromising.

Lenders also gravitate toward 7(a) loans because the guaranteed portion can be sold into the secondary market. This is a major profit center for most SBA lenders and a key reason the program is so widely offered. Selling the guarantee frees up balance sheet capital and allows lenders to originate additional loans without carrying long term exposure. As a result, 7(a) lending is available across national banks, regional institutions, credit unions and non bank SBA lenders, each applying its own internal credit overlays.

Approval odds in 7(a) lending are driven far more by cash flow integrity than by collateral coverage. Global cash flow has to support repayment after all business and personal obligations are included. Deposit behavior must line up with reported revenue, utilization needs to stay within reasonable bands and inconsistencies get flagged quickly. Documentation quality matters a lot here because 7(a) files pass through multiple review layers before getting to closing. When the numbers add up, deposits behave as expected and utilization stays under control, underwriting tends to move quickly.

The standard maximum SBA 7(a) loan amount remains $5 million. However, manufacturers operating under NAICS codes 31 through 33 may now qualify for 7(a) loans up to $10 million under expanded SBA guidelines. This increase reflects SBA prioritization of capital intensive production businesses and gives manufacturers more room to finance facility expansion, automation and large equipment purchases that were previously limited by loan size limits.

SBA 504 Loans

The SBA 504 program is purpose built for owner occupied commercial real estate and large equipment purchases. It uses a two-piece financing structure, which is designed to reduce lender risk and deliver long-term fixed rate financing to the borrower. In a standard transaction, a bank provides a first lien covering approximately 50% of the total project cost, while a Certified Development Company provides a second lien covering 40%. The borrower contributes the remaining 10%.

This structure results in lower monthly payments and interest rate stability compared to conventional real estate loans. For borrowers purchasing or constructing facilities they plan to occupy long term, 504 often produces the most favorable capital structure available through SBA programs.

However, the 504 program comes with additional complexity. These loans involve more third parties, longer timelines and stricter documentation requirements than 7(a) transactions. Appraisals, environmental assessments, construction budgets and tenant analysis play a central role in approval. Any weakness in valuation or project viability can stall or kill a deal late in the process.

Special use properties such as hotels, daycares, car washes and medical facilities typically require higher equity contributions and stronger DSCR to support the loan. Lenders may also require additional liquidity reserves and documented industry experience to offset operational risk.

The SBA increased 504 loan limits to $10 million for manufacturers operating under NAICS codes 31 through 33. This change removed a major constraint for capital-intensive manufacturers and expanded the program’s usefulness for facility expansion and equipment heavy projects.

SBA Express Loans

SBA Express loans are designed for speed, not flexibility. They offer faster decisions but smaller loan amounts, with delegated authority that allows lenders to approve files internally without full SBA review at submission. In exchange for that speed, the SBA guarantee percentage is lower, which increases lender exposure and tightens internal credit standards.

Because of that reduced guarantee, lenders reserve Express for borrowers who already look clean on paper. Strong personal credit, consistent deposits, low utilization and straightforward uses of funds are ideal here. Business owners with complex ownership structures, layered debt, equity sourcing questions or inconsistent financials find it difficult to get approved for Express loans.

Express is also limited by use case. It works best for working capital, small equipment purchases or refinancing simple conventional debt but it is not the right solution for acquisitions, real estate or situations where global cash flow requires explanation. It's easy to assume that Express is a shortcut around full underwriting but in practice, it's the opposite. Only the lowest risk applicants move through Express underwriting easily.

SBA Microloans

SBA Microloans are issued through nonprofit intermediaries rather than traditional banks. Loan amounts are capped at $50,000 and the program is designed to serve early stage businesses, startups or borrowers who do not yet have the financial depth required for standard SBA programs.

Microloan underwriting places a greater emphasis on the business plan, use of funds and borrower engagement than on historical cash flow and numbers. Intermediaries often work closely with borrowers, combining financing with technical assistance or business counseling. This makes microloans accessible to businesses with limited operating history, thinner credit profiles or incomplete financial statements.

The tradeoff is cost and structure. Interest rates are higher than 7(a) or 504 loans, and repayment terms are shorter, often ranging from five to seven years. Collateral requirements vary by intermediary and personal guarantees are usually required.

Microloans work best as a stepping stone. They can be great for initial access to capital, helping borrowers establish repayment history and allowing businesses to build the financial track record needed to qualify for larger SBA programs in the future. They aren't the right product for acquisitions, real estate purchases or capital-intensive expansions.

SBA Eligibility Rules That Drive Fast Approvals

Eligibility determines whether an SBA loan can move forward at all. Many borrowers assume eligibility is just a formality and focus their preparation on cash flow, credit score or collateral but this is actually where most declines happen.

Eligibility screening happens before underwriting and is conducted through automated systems designed to prevent files from advancing past non-negotiable SBA rules. If a file fails at eligibility, it will never even reach an underwriter, no matter how strong the financials appear. Borrowers are usually told the loan is not a fit but are rarely given the real reason for the decline.

Eligibility failures most often stem from ownership structure issues, affiliation rule violations, citizenship or residency problems, unresolved federal debt, ineligible business activity, or discrepancies on required SBA forms. Because lenders cannot override these rules, clearing eligibility issues upfront is one of the fastest ways to improve approval odds and shorten the timeline to funding.

Understanding eligibility from the start can help avoid some of the most frustrating SBA declines.

Basic SBA Eligibility Checklist

Here’s what lenders check first. They confirm the business operates for profit, uses funds for eligible purposes and falls within approved NAICS codes. Ownership percentages, business location and lawful operations are also reviewed immediately.

Citizenship or lawful permanent residency is required for all owners meeting SBA thresholds. Errors or omissions here trigger automated screening failures that you can't override.

SBA Form 1919 and Form 413 Triggers

SBA Forms 1919 & 413 matter more than most borrowers realize. They contain multiple trigger fields that can force additional review, including ownership percentages, citizenship status, prior government debt, pending litigation and personal asset disclosures.

Consistency across these forms, tax returns, credit reports and operating agreements is critical. Accuracy here matters more than speed because contradiction at this stage can stall an approval for weeks.

Bankruptcy and Past Credit Issues

Past bankruptcy does not automatically disqualify a borrower but most lenders require bankruptcies to be seasoned two to three years from discharge.

What matters is behavior after the bankruptcy. Low utilization, on time payments, stable deposits and documented explanations help restore lender confidence. Lenders care far more about what happens after the bankruptcy than the bankruptcy itself.

The First Five Checks SBA Underwriters Perform

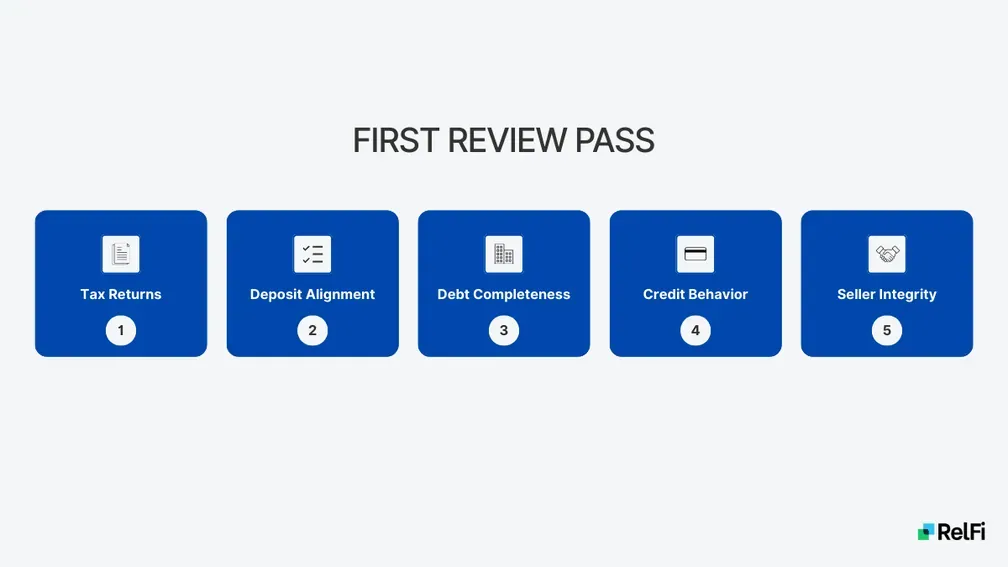

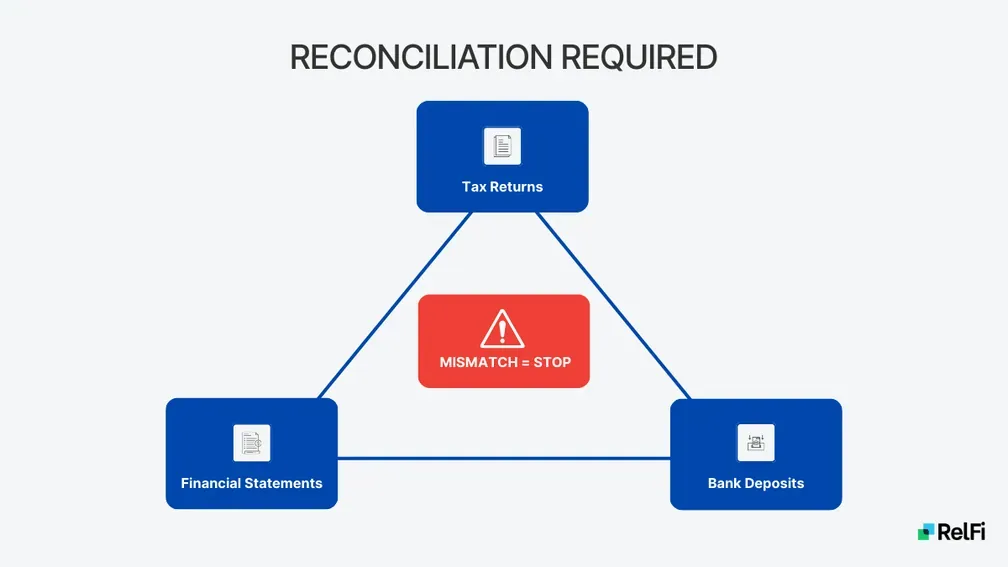

Once eligibility is cleared, underwriters open the file with a very narrow objective. Before building models or drafting a credit memo, they want to confirm two things: that repayment is supported by historical performance and that the documents presented tell a consistent story that can be verified.

These checks usually happen during the first review pass. Underwriters are not looking for perfection at this stage, only alignment. When tax returns, internal financials, bank statements and disclosure forms contradict each other, their confidence drops quickly.

Passing these initial checks moves the deal forward into deeper cash flow analysis and committee preparation. Files that are declined here will rarely recover without significant restructuring or clarification. This early review often determines whether underwriting accelerates or slows long before any formal decline language is issued.

Tax Return Line Items Underwriters Scan First

Underwriters immediately review a short list of tax return line items to get themselves familiar with the numbers. Gross sales, net income, depreciation, amortization, officer compensation, interest expense and total assets are typically scanned within the first few minutes of review.

These figures establish baseline credibility. If the tax returns and financials tell different stories, underwriters assume these inconsistencies point to weak bookkeeping, aggressive reporting or undisclosed risk that will surfer later in the process.

Deposit Consistency and Revenue Alignment

Deposits are compared directly against reported revenue to confirm they match. Underwriters look for things like: timing consistency, reasonable volatility and clear alignment with the business model. Spikes, gaps or irregular patterns will trigger follow up questions that have to be answered.

Reported revenue doesn’t mean much if the deposits don’t back it up. When there’s a conflict between financials and bank statements, lenders trust the bank statements.

Debt Completeness Verification

Underwriters lean on more than credit reports to assess leverage. They cross reference disclosed debt schedules against tax return interest expense, recurring bank statement payments and UCC filings.

Any mismatch here raises red flags. Hidden or undisclosed debt is one of the most common reasons global cash flow fails late in underwriting, even on otherwise strong files, so it's important to flag this early to save time and resources.

Credit Behavior and Character Signals

Beyond credit score, underwriters focus on behavior patterns. Utilization trends, repayment consistency and account history matter a lot more than a single snapshot score.

One of the strongest default predictors is an account closed by the creditor. Committees view this as evidence of a breakdown in financial discipline and it carries more weight than isolated late payments or short term utilization spikes.

Seller Side Integrity in Acquisition Deals

In acquisition scenarios, seller documentation is scrutinized early because it directly affects deal viability. Incomplete tax returns, unexplained add backs or unclear payoff statements slow down underwriting immediately.

Seller cooperation often determines how smoothly a deal progresses. If sellers are slow, defensive or unable to substantiate their numbers, the lenders will lose confidence in the deal quickly.

The DSCR Math That Determines Whether You Get Approved

Most borrowers misunderstand SBA loan DSCR requirements because they rely on simplified formulas or forward looking projections that lenders do not use. SBA lenders base repayment analysis on trailing performance, apply strict add back standards and test payments under stressed conditions rather than best-case assumptions.

Understanding how lenders actually calculate DSCR and global cash flow fundamentally changes how a borrower prepares their file. When repayment capacity is evaluated the lender’s way, weaknesses surface earlier and can be addressed before underwriting or committee review.

The Exact DSCR Formula Lenders Use

Underwriters calculate DSCR using a standardized formula designed to reflect historical repayment ability, not just projected growth. Net income is combined with depreciation, amortization, interest expense and clearly allowable rent add backs, then divided by total annual debt service, including the proposed SBA loan payment.

This calculation anchors the entire credit decision. Because it is based on trailing results, it exposes weaknesses that forward looking projections can hide. Aggressive assumptions or loosely supported add backs are rarely accepted and often draw additional scrutiny rather than improving approval odds.

What Add-Backs Are Accepted vs Rejected

Accepted add backs are limited to items that lenders view as clearly non-recurring or non-cash in nature. These typically include depreciation, amortization, documented one time settlements and excess owner compensation above market norms when supported by payroll data or industry benchmarks.

Rejected add backs include personal expenses run through the business, undocumented travel or entertainment, lifestyle costs and bonuses that cannot be verified or justified. These items reduce credibility and often lower DSCR rather than improving it, especially in committee review.

Cash Flow Patterns That Look Weak But Are Actually Stable

Some businesses display volatility that appears risky at first glance but is stable over time. Seasonal operations such as landscaping and snow removal, CPA firms with tax season spikes, medical practices with predictable accounts receivable cycles and holiday driven retail often fall into this category.

Lenders approve these files when historical data shows repeatable patterns and off season liquidity is sufficient to cover fixed obligations. Consistency over multiple years matters much more than smooth month to month performance.

Cash Flow Patterns That Look Strong But Are Actually Weak

Other files appear stable until underwriters analyze the underlying mechanics. Common examples include commingled deposits that inflate revenue, accounts receivable cycles extending beyond 60-120 days, customer concentration that masks dependency risk and revenue artificially made to look steady by batch processed deposits.

These files often fail once deposits are mapped against actual operations. When cash flow strength is driven by timing or structure rather than by sustainable demand, lenders adjust risk profiles quickly and approval odds drop.

SBA Loan Calculator Insights Borrowers Misunderstand

SBA loan calculators often create false confidence because borrowers use them as approval tools rather than screening tools. These calculators show estimated payments, but they do not reflect how lenders evaluate risk or repayment durability.

Lenders use payment calculations to test survivability, not affordability based on optimistic assumptions. The question is not whether the payment feels manageable in a strong month, but whether cash flow can support it consistently under conservative conditions and stress scenarios. Approval ultimately depends on how the payment performs inside global cash flow and stress testing, not on what a calculator displays in isolation.

SBA loan calculators are useful, but they’re often misunderstood. When used correctly, an SBA loan calculator is an excellent screening tool.

How Lenders Calculate Your Payment

Underwriters calculate payments using the exact loan amount, interest rate and amortization term proposed. They do not average rates, assume refinancing or rely on projected growth.

For example, a $2 million SBA loan at a 10% rate amortized over ten years gets you a monthly payment of roughly $20,000. That payment becomes the baseline input for DSCR and global cash flow calculations. If the file cannot support that obligation, it will stall the approval regardless of the reported revenue.

Why Lenders Always Run a Stress Test

Lenders do not underwrite at today’s rate alone. They apply a stress test, typically adding two hundred basis points to the proposed rate and recalculating the payment.

If DSCR fails under the stressed payment, the file becomes vulnerable in committee review. Stress testing protects lenders against rate volatility and ensures borrowers can survive tightening credit conditions.

Deals that barely pass at current rates often fail once they're stress tested.

Liquidity Thresholds Matter More Than Borrowers Realize

Lenders look at liquidity as a survival shot clock, not a vanity metric.

This is how lenders categorize security:

0-3 months of coverage is weak.

3-6 months is acceptable.

6-12 months is strong.

12+ months provides meaningful stability.

Liquidity expectations often extend beyond closing. Many lenders expect borrowers to maintain reserves equal to 3-6 months of payments or roughly 10% of total project costs after funding. Files that drain liquidity to zero at closing raise concern even if DSCR passes.

Bank Statement Analysis and Hidden Debt Signals

SBA loan bank statement requirements exist because bank statements reveal operational truth that financial statements often obscure. Lenders rely on deposits, withdrawals and payment behavior to understand how the business actually functions day to day, not how it is summarized at month end or year end. Seasoned underwriters can tell what makes a business within minutes by reviewing its bank statements.

This analysis exposes revenue timing, liquidity discipline and how the business services its obligations. Borrowers who misunderstand the importance of bank statement review are often surprised by declines despite strong reported revenue and financials, because the cash does not move the way the financials suggest.

Utilization Thresholds That Trigger Review

Utilization behavior matters a lot more than borrowers realize. Banks internally bucket revolving credit usage into bands. Under 30% signals flexibility. 30-60% signals active use. Above 60% triggers an additional review. Anything above 80% signals dependence. This is why borrowers are often surprised when a bank reduces a credit line quietly and the SBA lender immediately begins asking questions.

Sustained utilization above 60% raises questions about liquidity discipline. Above 80%, lenders treat the line as a primary funding source rather than a buffer. SBA underwriters see this pattern and adjust risk ratings accordingly.

How Lenders Detect Hidden Debt

SBA loan hidden debt is one of the most common reasons files fail late in underwriting. Underwriters identify it through transaction analysis, not borrower disclosure alone.

They flag recurring ACH pulls, payments to fintech lenders, deductions that do not appear on debt schedules and UCC filings that were never listed. These discoveries trigger global cash flow recalculations that often break DSCR.

Most borrowers do not realize underwriters routinely find more debt than disclosed.

Patterns Lenders Flag Immediately

Certain bank statement patterns trigger immediate scrutiny because they point to cash management risk. Declining average balances, negative daily balances, frequent overdrafts, irregular owner injections, and altered or inconsistent statement formatting all raise red flags early in review.

Deposits that spike briefly and then disappear suggest artificial liquidity rather than sustainable operations. Transfers that lack a clear business purpose require explanation and documentation. When these patterns appear together, underwriters assume stress is being managed reactively rather than structurally.

Why Overdrafts Matter So Much

Occasional overdrafts with strong, documented explanations may be survivable in otherwise clean files. Repeated overdrafts or multiple negative balance days signal ongoing liquidity strain and poor cash controls.

Lenders treat overdraft behavior as one of the clearest predictors of future stress because it reflects day-to-day operating pressure. Even profitable businesses lose credibility when overdrafts appear frequently, as committees interpret them as evidence that cash flow is not being managed properly.

Equity, Collateral and Injection Rules That Shape Approvals

Borrowers often assume collateral is the key to approval but it's not. Cash flow is actually the key. Collateral matters but only after you can prove repayment. In SBA lending, lenders do not expect perfect collateral coverage but they do expect predictable cash flow and clearly sourced equity.

Missteps in equity injection or collateral disclosure create unnecessary friction. Undocumented funds, last minute transfers or incomplete collateral listings often cause avoidable delays and late stage declines.

How Lenders Verify Equity Injection

SBA loan equity injection rules require lenders to verify equity through bank statements, brokerage statements, gift letters and documentation of liquidation events. Deposits are traced back to known sources and seasoned for 60-120 days.

Equity that comes out of nowhere or cannot be tracked will stall an approval immediately. Even strong cash flow cannot overcome unresolved equity questions.

Injection Sources That Get Flagged

Certain equity sources consistently raise concern during SBA review. Borrowed funds disguised as equity, undocumented gifts, sudden unexplained balance increases and inter account transfers without a clear audit trail are common triggers for additional scrutiny.

Attempts to split equity into smaller deposits to avoid review thresholds do not reduce risk. They create it. Lenders interpret structuring behavior as an attempt to obscure source of funds, which increases compliance review and delays approval.

AML Thresholds and Structuring Concerns

Anti money laundering reviews apply to all equity sources, regardless of borrower strength. Transfers above ten thousand dollars automatically trigger a review and lenders are required to trace funds from origin to deposit.

Attempts to structure deposits to avoid reporting thresholds are treated as a risk indicator. Unanswered questions around equity sources are a common source of delays on files, even if credit and cash flow otherwise support an approval.

Collateral Standards in SBA Lending

SBA loan collateral requirements cause a lot of confusion because lenders must take all available collateral on loans above $500,000, but the SBA does not require full collateral coverage for approval. What is required is complete disclosure and proper lien placement.

Cash flow remains the primary approval driver. Strong, well documented repayment ability can compensate for limited collateral. On the other hand, strong collateral cannot compensate for weak cash flow and lenders will not approve deals where repayment depends on liquidation rather than operations.

Character and Behavioral Signals Lenders Weigh Heavily

Character influences SBA approvals as much as financial metrics, especially in files that sit near approval thresholds. While credit score is important, committees place significant weight on behavior patterns, consistency and the credibility of the borrower's explanations.

Borrowers often underestimate how closely these signals are evaluated. When financial strength and risk are closely balanced, character frequently determines the outcome.

Payment History and Utilization Patterns

Lenders examine how obligations are managed over time, not just whether payments were made. Consistent on time payments, low and stable utilization and diversified credit lines signal financial discipline and planning.

High utilization, erratic payment behavior or rapid balance growth raise doubts. These patterns suggest reactive cash management rather than controlled operations, which increases perceived risk.

Accounts Closed by Creditor

An account closed by the creditor is one of the strongest predictors of future default in SBA lending. Committees treat this as evidence of a prior breakdown in financial responsibility that goes beyond temporary hardship.

This signal often outweighs isolated late payments or short term utilization spikes because it reflects a lender’s decision to exit the relationship, not a borrower’s isolated mistake.

Explanations That Strengthen a File vs Those That Fail

Explanations that are supported by documentation strengthen files. Temporary medical issues, resolved litigation or seasonal revenue dips backed by historical data and third party records are commonly accepted.

Narrative explanations without evidence don't work. Committees do not credit intent, effort or promises. They require documentation, solid patterns and proof that the issue is resolved and unlikely to recur.

Identity Theft Character Example

In one case, a borrower suffered identity theft that severely damaged her credit profile. She provided police reports, an FTC affidavit and two years of repayment history after resolution. Deposits were stable and global cash flow was strong.

The lender approved the loan because post incident behavior demonstrated responsibility. Character evidence separated the file from typical high risk credit cases.

What Gets Approved vs What Gets Declined

Most borrowers don't understand why they got declined because they're focused on the wrong things. Outcomes follow consistent patterns that repeat across lenders, industries and deal sizes, regardless of how attractive a file may appear initially.

Understanding these patterns changes how files are prepared. This helps borrowers ensure their documentation and disclosures are in line with what lenders actually evaluate and avoid surprises late in the process.

What Gets Approved

Approved files tend to share the same core characteristics. DSCR is clean and remains intact after stress testing, global cash flow holds once personal obligations are included, deposits match the reported revenue and utilization stays within reasonable ranges. Explanations for any anomalies are documented clearly and supported by evidence.

Seller support frequently strengthens approvals, especially in acquisition deals. Properly structured seller notes, transition support agreements and price concessions reduce early stage cash pressure and improve stability during the ownership transition. These elements often tip borderline files into approval.

What Gets Declined

Declined files often look strong initially but contain structural weaknesses. Common causes include mismatched deposits and revenue, undocumented equity, concentration risk and excessive personal debt that breaks global cash flow.

One $2.1 million acquisition with excellent reported DSCR failed when seller deposits did not match revenue. Another borrower lost their $1.2 million approval after buying a new car in the middle of the process, with the loan pushing their utilization high enough to fail global cash flow.

Exception Categories Lenders Will Fight For And Those They Never Will

Not all exceptions are treated equally in SBA lending. Some exceptions are routinely approved when supported by strong documentation and overall file strength. Others are absolute stops, regardless of cash flow, collateral or borrower experience.

Understanding the difference prevents wasted time and false expectations. Borrowers who know which issues can be mitigated and which cannot focus their effort where it matters and avoid pursuing deals that no lender can actually fund.

Exceptions Lenders Will Fight For

Lenders will advocate for exceptions when overall risk is controlled. Borderline DSCR supported by strong liquidity, documented temporary disruptions and long standing seasonal patterns are common examples.

Character events supported by evidence, strong seller participation and contracted backlog that improves future cash flow also receive support.

Seller Financing Structures That Improve Approval Odds

Seller financing improves approval odds when structured to SBA seller note requirements, including full standby and proper subordination. Strong structures include seller notes aligned with SBA subordination terms, larger equity contributions negotiated through price adjustments, fixed payment support during transition periods and formal standby agreements.

Seller support ties the seller’s outcome to the deal and materially reduces lender risk.

Exceptions Lenders Will Never Approve

Certain exceptions cannot be approved regardless of strength elsewhere. These include financial crimes, gambling related activity, unverified citizenship, MCA payoff requests and altered documentation.

Attempts to restructure equity deposits to avoid compliance thresholds also trigger instant declines, as automated screening systems are designed to detect structuring behavior.

Committee Behavior and Why Deals Die After Term Sheets

Borrowers often assume that a term sheet means an approval. In SBA lending, a term sheet simply means the file has cleared early screening and underwriting believes that there's a viable deal here. Final approval happens much later, at committee.

Committee review is where risk is either accepted or rejected at the portfolio level. This stage is less forgiving than underwriting and far less transparent to borrowers.

Why Committees Override Underwriters

Committees override the underwriting team much more often than borrowers realize. At strong lenders, roughly 25% of conditionally approved SBA loans are declined at committee. At newer lenders, override rates can reach 50%.

Overrides occur when portfolio level concerns outweigh borrower level strength. These include industry concentration limits, geographic exposure caps, internal stress test results and capital allocation shifts that occur after underwriting begins.

Relationship managers and underwriters may support a deal, but once the credit committee sets its position, there is no flexibility left. Borrowers never see these internal constraints. RelFi tracks these shifts across lenders and places deals where the credit box is actually open, which can drastically affect the outcome.

Deals That Die Even After Deposits Are Paid

Many borrowers are shocked to learn that deals can die after paying deposits and signing term sheets. This typically happens when new risk emerges late in the process.

Common causes include appraisals coming in below purchase price, environmental issues requiring additional remediation, updated financials showing revenue decline or seller documentation falling apart under scrutiny.

Committees will also reverse approvals when new liabilities appear mid process or when borrowers delay critical documentation. Late surprises reduce confidence and make the borrower look unreliable.

How Borrower Behavior Influences Committee Votes

Borrower behavior during underwriting directly affects committee perception. Slow responses, inconsistent explanations and fragmented document delivery weaken underwriter advocacy.

Responsive borrowers with organized documentation give underwriters confidence to defend the file. Committees interpret behavior as a proxy for how the business will be managed post funding.

Behavior during underwriting is a part of underwriting.

Timelines, Delays, and What Really Slows Down SBA Loans

Borrowers often ask why SBA loans take so long and blame the SBA for slow timelines, but the SBA itself is rarely the bottleneck. Here's what the data actually shows: The majority of delays occur before the file ever reaches final SBA review.

Understanding where delays originate allows borrowers to control what they actually can.

The Real Delay Breakdown

Delay data follows a consistent pattern. Borrower side delays account for roughly 50% of timeline extensions. Lender processing contributes about 15%. SBA processing accounts for roughly 10%. Certified Development Company delays also represent about 10% for 504 Loans.

The remaining delays come from third party vendors such as appraisers, environmental engineers, contractors and insurance providers.

Fastest Possible Approval Timelines

High quality files move quickly. For clean files, when borrowers ask how long an SBA 7(a) loan takes to close, the answer is typically 30-45 days. A clean 504 loan typically closes in 45-60 days.

These timelines require reconciled financials, fast borrower responses and no third party complications.

Third Party Bottlenecks Borrowers Never Expect

Many timeline failures happen outside the lender's control. Appraisal scheduling commonly adds three to five weeks. Environmental reviews can easily add weeks or months if issues surface.

IRS transcript delays, contractor bid revisions, landlord negotiations and insurance binding are also common reasons for delays. Organizing and coordinating these items can shorten your timeline and reduce potential delays.

How Most SBA Loans Fail Before Underwriting

The biggest myth in SBA lending is that underwriting kills deals but the truth is, most deals get declined before underwriting ever begins. This explains why borrowers feel their SBA loan application keeps getting kicked back without a clear explanation.

Early screening catches inconsistencies that borrowers don’t even realize are there. That’s why SBA loans can feel slow even when the financials look strong.

Early Screening Failures Borrowers Never Hear About

Lenders run automated checks on tax returns, ownership structure, equity sourcing and documentation before assigning an underwriter.

Common failures include mismatched tax returns and internal financials, ownership percentages that do not line up across forms, missing equity documentation and unexplained deposit behavior.

These failures stop files before anyone ever explains what went wrong.

ETRAN, OFAC and Identity Verification Checks

ETRAN and OFAC also perform automated validations borrowers never see. They flag prior SBA defaults, unresolved federal debt, address mismatches, multiple EINs tied to one guarantor and identity discrepancies. This is why borrowers often believe ETRAN declined their SBA loan without explanation.

Again, borrowers are rarely told the specific reason for the decline. Lenders are prohibited from disclosing ETRAN screening criteria, which leads many borrowers to misdiagnose the reason for decline.

OCR and AI Validation Mechanics

Modern underwriting platforms use optical character recognition and anomaly detection to validate documents. These systems identify rounding errors, altered PDFs, inconsistent notation and numerical mismatches across forms.

Tolerance levels can be as tight as 0.007%. Minor discrepancies that looks harmless to borrowers can cause serious delays.

Why 60-70% of Files Fail at Submission

Submission is the true choke point in SBA lending. 60-70% of files fail here due to unreconciled financials, undocumented equity, incomplete SBA forms, mismatched deposits or global cash flow that cannot be calculated cleanly.

That means once your file reaches underwriting, it's already cleared the toughest hurdle.

Documentation Patterns That Speed Up or Kill SBA Loans

Documentation quality shapes lender perception earlier than most borrowers realize. Underwriters look at hundreds of applications. They tend to treat organized, complete submissions as signals of disciplined operations, while disorganized or inconsistent files are viewed as potential predictors of future problems.

Clean documentation accelerates approval because it reduces follow-up requests, minimizes reconciliation work and gives underwriters confidence heading into committee review. Poor documentation has the opposite effect.

Documentation Errors That Stall Files

Files frequently stall due to basic but costly errors. Missing signatures, outdated financial statements, unsigned tax returns and debt schedules that do not match credit reports are common reasons.

Each error forces clarification requests and resets internal review timelines. Multiple small errors compound quickly and can turn an otherwise easy deal into a slow, frustrating process.

Packaging Mistakes That Signal Operational Weakness

Packaging quality matters because it reflects how the business is managed. Unlabeled files, blurry photos instead of proper PDFs, piecemeal uploads and conflicting versions of key documents undermine confidence. To an underwriter, that kind of disorganization signals how the business is likely run day to day.

Underwriters interpret messy packaging as a sign that recordkeeping and internal controls may also be weak.

Debt Schedule and Personal Financial Statement Conflicts

Underwriters cross reference debt schedules against bank statements, credit reports and tax return interest expense to confirm leverage is fully disclosed. Even a single undisclosed obligation can break global cash flow and trigger a recalculation.

Conflicts between disclosed debt and observed payments are among the most common late stage decline triggers because they suggest either oversight or intentional omission.

Seller Side Issues That Kill Acquisition Deals

Many acquisition deals fail due to seller side problems rather than borrower weakness. Sellers may provide incomplete or inconsistent financials, resist supporting the transaction with a seller note or fail to explain deposit discrepancies that underwriters flag.

Ordering the wrong type of appraisal is another frequent mistake. Reorders typically add four to six weeks and often fall apart purchase timelines when sellers or buyers cannot extend contracts.

SBA 504 Loans and Real Estate: Structure, Requirements and Failure Points

SBA real estate loans follow a different approval path than working capital or acquisition financing. They involve more third parties, longer timelines and stricter underwriting standards because repayment depends on both operating performance and property value.

Understanding these dynamics prevents avoidable failure. Many strong operating businesses struggle with SBA real estate approvals simply because the real estate components are underestimated or handled too late in the process.

The Three Part Structure of a 504 Loan

A standard SBA 504 loan uses a three part capital structure designed to balance risk between the borrower, the lender and the SBA. A bank provides a first lien covering approximately 50% of the total project cost. A Certified Development Company provides a second lien covering 40%. The borrower contributes the remaining equity, typically 10%.

Special use properties often require 15% or more equity due to higher operational risk. This structure reduces lender exposure while allowing borrowers to access long term fixed rates that are difficult to achieve through conventional financing.

Why Real Estate Deals Fail

Real estate deals fail for reasons borrowers often underestimate because the issues emerge later in the process. Appraisals can come in below contract value, environmental reviews may identify remediation requirements, construction budgets may lack sufficient detail or tenant mix may weaken projected cash flow.

Any factor that undermines valuation, occupancy stability or repayment capacity can stall or kill a deal.

Special Use Property Requirements

Special use properties such as hotels, daycares, car washes, medical facilities and self storage face stricter underwriting standards. Lenders often require DSCR above 1.3, additional post close liquidity reserves and clear documentation of operator experience in the property type.

These files must demonstrate operational competence in addition to financial viability. Experience gaps or overly optimistic projections are common failure points.

Construction and Renovation Risk Factors

Construction and renovation transactions introduce additional layers of risk. Lenders require detailed contractor bids, realistic contingency budgets, defined draw schedules and appraisals that reflect the proposed improvements rather than current condition.

Any missing, outdated or inconsistent information causes immediate delays. Borrowers who coordinate contractors, architects and appraisers early shorten timelines and reduce the risk of late stage failure.

Economic Conditions That Influence SBA Approvals in 2026

Economic conditions directly shape lender behavior, even when borrower fundamentals remain unchanged. In 2026, fluctuating interest rates, uneven sector performance and shifts in secondary market pricing continue to influence approval thresholds and underwriting posture among lenders.

Borrowers who understand these dynamics are much better positioned to anticipate lender concerns, prepare documentation proactively and select lenders whose risk appetite is more in line with current market conditions.

Higher Rates and Tighter DSCR Requirements

As interest rates rise, loan payments increase and margins for error shrink. Lenders respond by raising minimum DSCR requirements and applying more conservative stress tests, particularly on longer term obligations.

Acquisition and real estate deals are affected most because higher payments compress cash flow. In these environments, liquidity carries more weight and files that rely on thin coverage or optimistic assumptions face increased scrutiny.

Economic Pressure on Specific Industries

Certain industries experience more pressure during periods of economic uncertainty. Retail, restaurants, residential construction and marketing driven businesses face increased scrutiny in 2026 due to their sensitivity to discretionary spending and cyclical demand.

Lenders request deeper documentation in these sectors to confirm revenue stability, customer diversification and cost controls before advancing approvals.

How Secondary Market Behavior Affects Approvals

Secondary market premiums directly affect lender behavior. When premiums fall, lenders tighten credit boxes, reduce exceptions and prioritize lower risk files. When premiums rise, lenders compete more aggressively and expand acceptance criteria.

Borrowers feel these shifts even when their business has not changed. Approval outcomes are often influenced as much by timing and market conditions as by individual borrower strength.

SBA SOP Updates That Matter in 2025 and 2026

The SBA updates its Standard Operating Procedures regularly but only a small subset of changes materially affect approval outcomes. Many updates clarify existing rules rather than changing behavior. The 2025 and 2026 revisions, however, introduced several enforcement shifts that meaningfully altered how lenders screen and approve files.

Borrowers often underestimate these changes because they are enforced quietly through eligibility screening and underwriting standards rather than explicit decline language. Files that ignore these updates frequently stall late in the process or fail outright.

MCA and Factoring Payoff Prohibition

Effective June 1, 2025, SBA rules prohibit the use of SBA loan proceeds to pay off merchant cash advances or factoring debt. Lenders are not permitted to approve files where proceeds will be used to retire these obligations.

Even mentioning MCA payoff during intake can freeze a file. Borrowers carrying these products must exit them independently before SBA submission. Attempts to reframe MCA balances as short term loans do not survive review.

Affiliation and Ownership Structure Enforcement

Affiliation rules continue to tighten. The SBA requires combining revenue, headcount or exposure when owners control multiple businesses, share management or maintain economic dependence.

Family ownership structures, shared leases, management agreements and cross guarantees frequently trigger affiliation reviews. Incorrect assumptions here cause size standard failures that cannot be appealed.

Collateral and Guarantor Obligations

Past bankruptcy does not automatically disqualify a borrower. Loans above $500,000 require pledging all available collateral.

The SBA does not require full collateral coverage, but omission or concealment of collateral stops files immediately. Strong cash flow mitigates collateral gaps. Collateral never mitigates weak cash flow.

Increased Loan Limits for Manufacturers

Manufacturers operating under NAICS codes 31 through 33 may now access SBA loans up to $10 million under both 7(a) and 504 programs.

This expansion reflects SBA prioritization of capital intensive industries and removes a historical cap that limited facility expansion, automation and equipment upgrades.

Regional SBA Lending Differences in 2026

Underwriting behavior varies meaningfully by region, even under the same SBA programs. Borrowers often receive inconsistent answers not because their file changed, but because they applied to lenders whose geographic underwriting culture does not match their business model.

Understanding these regional differences improves lender selection and approval odds. Choosing a lender whose portfolio experience matches the industry, deal structure and operating style of the business reduces friction and increases the likelihood that a file advances smoothly through underwriting and committee review.

West Coast Underwriting Culture

West Coast lenders favor automation, clean digital accounting systems and predictable deposits. They are comfortable with SaaS, logistics, e commerce and professional services.

They are less tolerant of cash heavy operations, inconsistent bookkeeping or manual financial processes. Files must be clean and exportable.

East Coast Underwriting Culture

East Coast lenders emphasize documentation discipline, tax return consistency and strong personal credit. They prefer mature industries and borrowers with long operating histories.

They expect clean corporate structures and complete financial records.

Midwest Underwriting Culture

Midwest lenders prioritize stability and collateral. They work well with manufacturing, agriculture related businesses, construction firms and equipment heavy operators.

They move cautiously with high growth or tech focused businesses due to unfamiliar cash flow profiles.

Southeast Underwriting Culture

Southeast lenders weigh character and communication heavily. They grant exceptions when documentation supports the narrative and borrower responsiveness is strong.

Transparency and fast responses materially influence outcomes.

Mountain and Southwest Underwriting Culture

Lenders in these regions manage portfolios exposed to hospitality, logistics, construction and energy influenced industries. They require stronger liquidity and closely review tenant mix for real estate deals.

Local industry familiarity improves approvals.

Industry Specific SBA Underwriting Rules Borrowers Need To Understand

Industry drives underwriting behavior long before DSCR is calculated or collateral is reviewed. Lenders rely on internal performance data from thousands of prior files to shape industry specific credit boxes, risk tolerances and documentation expectations.

Borrowers benefit when they understand how their sector is viewed because approval standards are not applied uniformly across industries. The same financial profile can be treated very differently depending on historical default rates, revenue stability and operational complexity associated with the business’s industry.

Restaurants and Food Businesses

Restaurant underwriting places heavy emphasis on operator experience and unit level controls. Lenders evaluate food cost management, labor discipline, vendor payment history and the consistency of point of sale deposits relative to reported sales.

Because restaurant failure rates remain high, lenders require stronger liquidity buffers and closer scrutiny of cash flow volatility. Clean, verifiable deposits and documented experience operating similar concepts materially improve approval odds, while aggressive growth assumptions or thin reserves weaken files quickly.

Healthcare and Medical Practices

Healthcare underwriting centers on accounts receivable rather than immediate cash flow. Lenders review AR aging, payer mix, reimbursement cycles and denial rates to assess predictability of collections.

Practices with diversified payer sources and stable reimbursement patterns receive more favorable treatment. Heavy reliance on a single payer, extended AR cycles or frequent write offs increase perceived risk and lead to tighter underwriting standards.

Construction and Contracting

Construction underwriting evaluates backlog quality alongside operational controls. Lenders assess job costing systems, bonding capacity, margin discipline and the proportion of fixed price versus cost plus contracts.

Lenders also focus on whether backlog is profitable, diversified and supported by reliable customers with timely payment histories.

Logistics and Transportation

Logistics and transportation businesses are evaluated on fleet condition, utilization rates, maintenance discipline and shipper concentration. Lenders review maintenance records and capital replacement plans to assess operational sustainability.

Diversified customer bases and well maintained fleets reduce risk perception, while overreliance on a small number of shippers or aging equipment increases scrutiny and weakens approval odds.

Manufacturing and Production

Manufacturing deals involve deep review of equipment condition, order patterns, customer diversification and inventory controls.

Recent SBA limit increases allow manufacturers to access up to $10 million, enabling larger expansion projects.

A hydrovac operator secured $3.3 million due to strong utilization data and contract renewals. A CPA firm secured $1.89 million because seasonal revenue remained stable year over year.

Hidden Decline Patterns Borrowers Never Hear About

Most SBA decline letters do not reflect the actual reason funding was denied. Lenders typically cite broad explanations such as “credit factors” or “cash flow concerns,” while deeper structural or behavioral signals drive the actual decision.

Borrowers who understand these hidden patterns can address issues earlier in the process, before underwriting or committee review turns them into hard stops.

Automated Screening Failures Borrowers Miss

Automated screening flags ownership inconsistencies, identity mismatches, prior SBA program issues and documentation conflicts before underwriting even begins. These checks are enforced through systems tied to eligibility validation and compliance.

Borrowers rarely know these failures occurred because lenders are not permitted to disclose the specific screening criteria. As a result, many borrowers focus on fixing the wrong problem after a decline.

Deposit Behavior That Signals Trouble

Lenders map deposit activity month by month to identify trends that financial statements often mask. Declining average balances, irregular owner injections and inconsistent revenue rhythms raise concern, even when reported sales remain stable.

Deposits reveal true business health more reliably than profit and loss statements because they reflect how cash actually moves through the business, not how it is categorized after the fact.

Early Warning Default Patterns

Certain behaviors consistently predict default. These include repeated negative balance days, steadily depleting reserves, litigation initiated during underwriting and neglect of smaller obligations while larger payments are prioritized.

Committees decline files exhibiting these patterns despite DSCR looking strong because the behavior suggests future stress rather than temporary disruption.

Hidden Debt Signals Underwriters Always Catch

Underwriters detect hidden debt through transaction analysis and document cross checks, not borrower disclosure alone. ACH pulls from fintech lenders, undisclosed credit lines, recurring payments that do not appear on debt schedules and unreported UCC filings are common discoveries that raise issues.

Lenders routinely find 30-40% more debt than borrowers disclose. When this debt surfaces late, global cash flow is recalculated and approval odds drop sharply.

The Borrower Playbook for SBA Success in 2026

Borrowers who get approved prepare their files the same way lenders review them, rather than leaning on how strong the business looks at a glance or what they think should be acceptable. They focus on alignment, consistency, and documentation that holds up through eligibility screening, underwriting and committee review.

Borrowers who follow these steps reduce surprises and materially improve approval odds.

Step 1: Reconcile All Financial Statements

Tax returns, internal financial statements and bank deposits must tell the same story. Revenue, expenses and cash movement should be aligned without forcing explanations.

Any mismatch raises suspicion and delays review. Underwriters assume inconsistencies reflect either weak bookkeeping or undisclosed risk, both of which slow the process immediately and reflect negatively on the business owner.

Step 2: Calculate DSCR and Global Cash Flow the Lender Way

Borrowers should calculate repayment capacity using trailing results and stressed payments, not forward-looking projections or best-case assumptions. This is why using a calculator that models DSCR and stress testing the way lenders do matters.

Running the numbers the lender’s way exposes weaknesses early and prevents false confidence based on calculator outputs that do not survive underwriting or committee review.

Step 3: Season and Document Equity

Equity should remain in a single account for at least 120 days prior to submission. The source of funds must be clearly traceable and documented from origin to deposit.

Unexplained deposits, last minute transfers or attempts to structure contributions introduce compliance review and delay approvals unnecessarily.

Step 4: Prepare a Complete Guarantor File

Guarantors are evaluated as co borrowers, not secondary parties. Personal financial statements, tax returns, credit explanations and asset documentation must be complete and consistent.

Well prepared guarantor files strengthen committee confidence and reduce follow up requests that stall files late in the process.

Step 5: Pre Coordinate Third Parties

Appraisals, environmental reports, contractor bids, insurance binders and landlord agreements should be coordinated early, not after underwriting begins.

Waiting to engage third parties is one of the most common causes of avoidable delays, especially in real estate and construction related transactions.

Step 6: Control the Narrative Before Committee Review

Committees do not read full files. They read credit memos that summarize risks, mitigants and explanations.

Any explanation that matters must be documented where it appears in that memo. If the narrative is not documented, it does not exist to the committee, regardless of what was discussed verbally.

What We Still Do Not Know Yet

SBA lending continues to evolve as technology, capital markets and economic conditions shift. While approval mechanics are well understood today, several developments remain uncertain and are likely to shape underwriting behavior and approval outcomes in the coming years.

Borrowers who monitor these trends can better anticipate changes rather than reacting to them mid process.

AI Assisted Underwriting Trends

AI driven document validation and anomaly detection may shorten timelines but they also tighten tolerance for inconsistencies. As these systems mature, minor discrepancies that previously passed manual review may trigger automated flags.

Non standard accounting exports, custom reports or altered document formats may face increased scrutiny as validation becomes more rigid.

Rate Stabilization and Credit Box Adjustments

If interest rates stabilize, lenders may gradually widen credit boxes and reduce stress test severity. This would benefit borderline files that currently fail due to thin coverage or conservative assumptions.

However, credit box expansion tends to lag rate movement. Borrowers should not assume immediate relief even if rates flatten.

Secondary Market Cycles

Secondary market loan premium cycles continue to influence lender appetite. When premiums rise, lenders compete more aggressively and approve a wider range of files. When premiums compress, lenders tighten standards and reduce exceptions.

Monitoring this cycle helps predict approval behavior even when borrower fundamentals remain unchanged.

Frequently Asked Questions

How long does an SBA loan take to get approved?

Most SBA loans close in 30-60 days depending on the deal quality and third party timelines. We've seen clean 7(a) deals reconciled financials, responsive borrowers and no third party complications often close in 30-45 days. 504 loans typically take longer due to CDC coordination, appraisals and environmental reviews.

What credit score do you need for an SBA loan?

Most lenders prefer credit scores above 650 for SBA approval in 2026. Exceptions are possible when borrowers demonstrate strong cash flow, clean deposits and documented explanations for past credit issues. Credit score alone never overcomes weak global cash flow or deposit inconsistencies.

Can you get an SBA loan with bad credit?

Yes, but only with compensating factors. Borrowers with weaker credit must show clean recent behavior, stable deposits, strong DSCR and documented explanations for prior issues. Late payments without resolution or accounts closed by creditors materially reduce approval odds regardless of score.

What disqualifies you from an SBA loan?

Automatic disqualifiers include unverified citizenship or residency, unresolved federal debt flagged in CAIVRS, prior financial crimes and intended misuse of funds such as MCA payoff. Affiliation rule violations and incomplete ownership disclosures also trigger eligibility failures. These issues must be resolved before submission, not during underwriting.

What DSCR do lenders require for SBA loans?

Most lenders require a minimum DSCR of 1.15 on a global cash flow basis. Acquisitions, real estate and higher risk industries often require 1.25 or higher. DSCR is calculated using trailing performance and stressed payments, not projections.

What does it mean if CAIVRS flags my SBA loan?

A CAIVRS flag indicates unresolved federal debt or prior government program issues and results in an automatic eligibility failure. These flags cannot be overridden by lenders and must be resolved before an SBA application can proceed.

How much equity do you need for an SBA loan?

10% equity is standard for most SBA transactions. Special use properties such as hotels, daycares, and car washes often require 15-20% due to higher operational risk. Equity must be fully sourced, documented and seasoned for 60-120 days.

Can seller financing help me qualify?

Yes, when structured correctly. Seller notes placed on full standby and properly subordinated reduce lender risk and improve global cash flow. Seller support often becomes the deciding factor on borderline acquisition files.

Why did my SBA loan get declined even with good credit?

Good credit does not offset weak deposits, global cash flow failures, seller side issues or documentation conflicts. Many borrowers with strong FICO scores are declined because deposits do not match up with the reported revenue or hidden debt breaks cash flow late. Credit score is one input but it's not the decision maker.

Does personal debt affect SBA loan approval?

Yes. All personal obligations are included in global cash flow, including mortgages, auto loans, credit cards and personal guarantees on other businesses. Personal debt frequently kills otherwise strong deals when the combined cash flow is recalculated.

Why do SBA loans get denied?

SBA loans are most often denied due to eligibility failures, weak DSCR, hidden debt, mismatched financial documents or equity sourcing issues. Many borrowers never learn the true reason because lenders cannot disclose ETRAN screening criteria or internal credit box mismatches. Addressing these issues requires understanding how lenders actually evaluate files, not relying on decline letters.

Why was my SBA loan denied?

SBA loan denials most often result from eligibility failures, weak DSCR, hidden debt that breaks global cash flow, mismatched deposits and reported revenue or documentation conflicts. Many borrowers never learn the real reason because lenders cannot disclose ETRAN screening criteria or internal credit box mismatches.

Why did my SBA loan get denied after approval?

SBA loans denied after conditional approval typically fail due to committee overrides, low appraisals, updated financials showing revenue decline or new debt taken mid process.

What is the difference between SBA 7(a) and 504 loans?

7(a) offers flexibility. 504 provides fixed rate real estate financing with a split structure. For borrowers comparing SBA 7(a) vs 504 and asking which is better, the decision comes down to flexibility versus long term fixed rate real estate economics.

Final Checklist Before Applying

This checklist reflects how lenders actually evaluate readiness, not what application portals advertise. Files that meet these standards move faster and face fewer late stage surprises.

Documentation Checklist

Reconciled tax returns, internal financials and bank deposits that tell the same story. Debt schedules that match credit reports and tax return interest expense. Equity that is fully sourced, documented and seasoned. Complete SBA forms submitted without gaps or inconsistencies.

Behavioral Checklist

Fast, consistent responses to information requests. Stable explanations that do not change mid process. Organized, labeled submissions delivered as complete packages rather than fragments. Borrower behavior here directly influences committee confidence and approval outcomes.

Connect With RelFi

RelFi structures SBA applications the way lenders actually review them. The goal isn't a conditional term sheet that falls apart later. We're aiming for a real approval that can survive eligibility screening, underwriting and committee review and actually funds. Get in touch with us here.