Types of Financing for Small Business: How to Choose the Right Fit

A practical breakdown of SBA loans, MCAs, equipment financing and more with a clear framework for choosing the right capital based on your goals.

Part 1 in the RelFi Business Funding Strategy Series

Small business financing always comes down to fit, not rates. After funding more than 10,000 businesses across the country, we see the same pattern repeat. When financing lines up with revenue cycles and repayment capacity, it drives growth. And when it doesn’t, even the lowest advertised rate can sink a company.

We built this guide to help you avoid that trap. We’re not here to stack up definitions. We’re here to give you a framework that lines financing up against the way your business actually runs.

Because here’s the reality: SMBs rely on outside capital at nearly every stage of growth. Covering payroll when a contract pays late. Stocking inventory before the holiday rush. Buying equipment that lets you land bigger jobs. The funding structure you choose decides whether that move creates momentum or drags you off course.

Most entrepreneurs only hear the sales pitch: fast approval, flexible terms, lowest rates. What they don’t hear is that every structure is built for a specific scenario. The right fit keeps a seasonal apparel brand in Denver humming through the winter. The wrong fit can bankrupt a construction subcontractor in Dallas who’s still waiting on receivables.

That’s why we break this into five practical steps:

- Identify your funding objective

- Understand the core types of funding options

- Compare true costs across structures

- Match repayment to the way your company earns revenue

- Plan your exit before you borrow

Do these five things and financing becomes less of a gamble. It becomes something you can control.

The key isn’t just chasing the lowest rate. It’s knowing how to weigh your model, your eligibility and your revenue rhythm so that you secure financing that works with you, not against you.

Why Choosing the Right Solution Matters

Securing a small business loan is one of the most important financial decisions you’ll make after you’ve built your product and proven demand. Get it right and funding becomes a growth engine. Get it wrong and obligations bleed your cash flow until the business loses balance.

The goal is to match financing structures to the way your business actually runs. Choosing from a list of options only works when the structure fits how you business actually operates. At RelFi, we look through three lenses:

- Timing — how fast funds actually land in your account

- Repayment cadence — daily, weekly, monthly, or revolving

- Risk tolerance — how much strain your cash flow can realistically absorb

Those three variables decide whether financing helps you grow or holds you back.

Here’s a real example. A logistics company in Durham borrowed $487,000 through a working capital facility, matched repayment to receivables and cleared the balance on schedule. Meanwhile, a restaurant group in Florida borrowed almost the same amount, $492,000, but stacked two daily-payment advances with no refinancing plan. Within six months, withdrawals were eating $41,000 a week and the company collapsed.

Same ballpark funding amount. Completely different results. The difference wasn’t luck. It was fit: clear objectives, repayment aligned to revenue and a defined exit path.

And here’s what surprises many owners. A traditional loan isn’t always the right answer. In practice, other financing structures often line up closer with the way revenue really flows.

What is small business financing?

Small business financing is the external capital you secure to keep operations moving. It might mean making payroll on Friday. It might mean financing equipment that will keep producing returns for a decade.

The most common business financing options include SBA loans, term loans, business lines of credit (LOC), merchant cash advances, equipment financing, revenue based financing, invoice factoring and asset based lending.

Here’s what typical structures look like:

- Term loans: $50,000 to $10 million, repayment over 1 to 10 years

- SBA loans: up to $5 million, terms up to 25 years

- Business LOC: $100,000 to $10 million, revolving access

- Merchant cash advances: funds delivered in 24 to 48 hours, factor rates 1.18 to 1.40, up to $5 million

- Equipment financing: 2 to 7 years, secured by the asset

- Invoice factoring or AR financing: 72 to 90 percent advance on receivables

- Asset based lending: credit secured by receivables, inventory, or equipment

- Commercial real estate financing: 5 to 25 years

- USDA loans: up to $25 million for rural enterprises

- Hard money loans: short term, collateral driven, usually 7 to 36 months

The right fit balances three factors:

- Use of funds: Are you bridging a short term cash gap or fueling expansion?

- Repayment timing: Daily, weekly, monthly, or revolving. It has to match how deposits arrive.

- Eligibility reality: FICO score, DSCR, collateral and guarantees determine what is actually available.

How to choose the right financing (5 steps that actually work)

- Define the objective. Are you bridging a short term cash gap or pursuing long term growth?

- Map the return on investment horizon. Will returns show up in weeks, months, or years?

- Match repayment to revenue. Daily, weekly, monthly, or revolving. It has to align with deposits.

- Check underwriting reality. SBA paperwork, DSCR at 1.25x, collateral and guarantees. Know the rules before you apply.

- Plan the exit. Always map out how you’ll cover the cost or refinance before you sign.

When managed the right way, financing becomes a deliberate growth strategy instead of a reactive scramble.

Step 1: Identify Your Funding Objective

Every financing decision starts with purpose. Ask yourself what exactly the business loan will do for the business. Cover payroll? Lock in a supplier discount? Open a new location? The clearer that answer, the easier it is to choose the right structure. Owners who skip this step often end up with capital that solves the wrong problem and that mistake costs far more than the interest rate on the paperwork.

Short-term needs like payroll, supplier payments, or seasonal inventory are best matched with working capital loans or merchant cash advances. They cost more, but they move quickly and are built to act as bridges, not anchors. Long-term goals such as buying new equipment, expanding facilities, or acquiring another company fit better with SBA loans or traditional term loans. These require more patience and paperwork, but the payoff is lower rates and repayment schedules that protect cash flow over time.

RelFi helped a specialty grocer in Denver borrow $350,000 on a six-month working capital facility to stock holiday imports. Because repayments lined up with December and January sales, the loan cleared by February and left them with over $150,000 in additional margin after costs.

A design firm in Minneapolis needed to borrow $300,000 over 12 months to expand staff. RelFi recommended a revenue-based financing structure that would be flexible with client billings but the owners opted for a lower-rate fixed loan instead. When two clients pulled back, the fixed payments drained more than $100,000 from reserves before they could adjust. The cheaper rate on paper actually ended up costing far more in practice.

A plastics manufacturer in Michigan saw its $10 million credit line reduced to $8.5 million with almost no warning. Payroll and vendor obligations still had to be met so we helped them secure a $1.4 million merchant cash advance. The funds hit in 48 hours and kept $3.8 million in production moving while management renegotiated the the credit line.

The sharper your objective, the more likely you are to secure financing that fits. This is where lenders zero in on credit score, revenue history and repayment capacity. Walk in without a clear plan and you’ll lose negotiating power over the structure. Come prepared and you can make the strongest case and walk out with terms that actually work for you.

Step 2: Understand the Core Types of Business Financing Options

Once you know your objective, the next step is understanding the landscape. Many business owners get stuck on the marketing pitch, fast approvals and low rates, without seeing that every financing option is built for a specific scenario.

Financing is more than a menu of one-off choices. It’s a spectrum that runs from long-term stability to fast-moving cash. On one side you’ll find SBA loans, term loans and bank credit. They are slower to close but cheaper over time. On the other side are merchant cash advances and revenue-based financing, built for moments when you need money in days, not weeks. In between sit flexible tools like lines of credit, equipment financing, invoice factoring and asset-based lending. Each offers a different mix of speed, collateral and cost. The trick is choosing the balance that fits how your business operates.

Example of fit versus mismatch

A roofing company in Dallas financed three trucks through a five-year equipment loan. The predictable payments matched the useful life of the assets and the company landed larger contracts right away. A restaurant in Atlanta, on the other hand, took a daily-payment advance to cover payroll. It worked for a few weeks, but when summer sales dipped, deposits couldn’t keep up and the withdrawals strained cash flow. Both facilities moved quickly, but only one matched the true objective.

No financing option is the best on its own. Each exists for a reason but the business owners who win are the ones who match the tool to the task.

Step 3: Compare the True Costs of Each Option

The right financing gives you more than a lump sum in the bank. It gives you a clear picture of how much you will repay, how quickly the funds arrive and whether the structure fits your revenue cycle.

How repayment changes the math:

- A $120,000 merchant cash advance with a 1.25 factor requires $150,000 in repayment. Expensive, but funds arrive in one or two days with minimal paperwork.

- A $250,000 SBA loan at 11 percent interest over 10 years creates payments of about $3,440 a month. Much slower to close, but manageable long-term.

- A $90,000 working capital loan at a 12-month term costs more than a bank product on paper, but the short horizon means you can move fast without tying up collateral for years.

Two products can have similar interest rates, but once you add in fees, repayment calendars and the frequency of payments, the actual cost diverges quickly. A financing option that looks expensive upfront can be the smarter move if it matches the timing of how your business operates.

A home goods retailer in New Jersey took on a $400,000 merchant cash advance to secure holiday inventory. The advance cost about $95,000, but seasonal sales generated $1.2 million in revenue, making it a profitable move despite the higher cost of capital. Another retailer in the same market waited on an SBA loan at 11 percent but the delay caused them to miss the holiday season entirely. On paper the SBA loan looked cheaper but this business owner missed a million-dollar opportunity.

At RelFi, we model the total repayment picture: dollars out, payment schedules and the real impact on your books. That way you can compare side by side and make decisions based on reality, not headlines.

Step 4: Match Repayment to How Your Business Gets Paid

The financing that looks good on paper can still hurt cash flow if repayment schedules do not line up with how deposits actually hit your account. The pace of your revenue has to guide the choice.

A restaurant group in Aventura, FL with $480,000 in steady monthly deposits took a $325,000 merchant cash advance to launch a new catering division and cover payroll during the ramp-up. Weekly payments of $9,500 worked because deposits were consistent and cash flow from existing locations kept pace.

A construction firm in Colorado with net-45 billing took a $300,000 advance on the same terms. Withdrawals started before client invoices cleared and cash dried up within three weeks. A $12,000 monthly term loan or a receivables-based line of credit would have fit better.

A landscaping company in Portland, OR drew $420,000 on a revolving facility in March. They paid it off in July after seasonal contracts cleared, even though the rate was higher than a bank loan. Timing made it work.

A SaaS company in Austin with $1.5 million in predictable monthly subscriptions secured a $3.2 million three-year term loan. Fixed payments matched deposits and the strong credit profile of the founders helped them lock in competitive pricing.

Before you sign, compare the repayment schedule to your sales forecast. If money is going out before revenue comes in, that capital will add pressure instead of stability. Lenders look at this right away when reviewing an application and it’s often the difference between getting approved and getting declined.

Step 5: Plan Your Exit Before You Borrow

Financing only works if you know how it ends before you start. Without a clear exit, even good terms can turn into a trap.

A medical supply distributor in Long Island took a $600,000 merchant cash advance with weekly withdrawals. After six months of clean repayment history, they refinanced into a bank facility and saved more than $120,000 in total cost.

A wholesaler in the greater St. Louis area tapped $350,000 in receivables financing against invoices due in 45 days. Because repayment was scheduled monthly, the invoices cleared before the second payment hit. Payroll stayed on time and the facility retired itself as soon as customers paid.

A marketing agency in West Hollywood borrowed $300,000 at a 1.26 factor. Instead of paying it off, they renewed four times across 18 months. By the end, they had repaid more than $300,000 on top the original borrowed amount. The product wasn’t the problem, they just didn't have an exit plan.

How you exit one facility directly impacts what you can qualify for next. SBA lenders and banks all look closely at repayment history, collateral and your business credit profile when setting pricing. Clean exits lead to faster approvals and better terms. Messy exits shut doors.

And the rules keep shifting. A recent change to the Small Business Administration’s SOP removed the ability to roll merchant cash advances into SBA loans. For business owners, that means one more reason to plan the exit up front. If you assume you can refinance later and the rules move under your feet, you may be stuck with expensive debt longer than expected.

The rule is simple. Plan your exit before you borrow. If you cannot map out how repayment or refinancing will work on paper, it will not work in practice.

Not sure which path fits your business? That’s what we do every day. Talk to RelFi and we’ll map your options before you sign. You can drop us a line here→ relfi.co/contact

Types of Business Funding

1. Working Capital Loans

Working capital loans are one of the most common small business financing options because they give business owners breathing room when timing doesn’t line up. Think of them as a bridge. They cover immediate operating gaps so you can keep moving without stalling growth.

Typical amounts range from $25,000 to $5 million, with repayment schedules between 6 and 24 months. The idea is simple: short-term capital that solves short-term problems.

You receive a lump sum upfront and repay in frequent installments. Approval is based more on recent deposits and revenue patterns than on collateral or FICO score, which makes underwriting faster. Many business owners receive offers within 24 hours. They move quickly and require less documentation but the cost is higher than longer-term options like SBA loans or traditional bank financing.

A boutique apparel chain in Knoxville, TN secured $425,000 ahead of the fall season to lock in supplier discounts. Strong October and November sales let them clear the balance in just 70 days while keeping their $600,000 line of credit untouched for future needs.

A digital agency in Austin used a six-month $350,000 facility to cover vendor payments while waiting on three receivables worth $720,000. The structure kept payroll stable and gave them breathing room until client funds landed.

A landscaping company in Northwest Ohio borrowed $280,000 before spring and paid it off with April and May contracts. Because repayment aligned perfectly with seasonal revenue, the facility added stability instead of strain.

Key features:

- Lump sum capital with short repayment timelines

- Frequent payments tied to revenue flow

- Faster underwriting with less documentation

- Approvals often based on bank deposits more than collateral

Because repayment begins almost immediately, working capital loans only make sense if you can point to clear, near-term returns. Using them to cover ongoing losses or multi-year projects can put the business under pressure. Even at a higher cost, they make sense when you can point to exactly how the money will come back as revenue.

Working capital is the heartbeat of daily operations. When deposits are steady but timing is off, these loans keep payroll on time and growth moving forward. The stronger your credit and revenue history, the better the terms you can lock in.

2. SBA Loans & SBA Lenders

SBA loans are often called the gold standard of business financing. They combine lower borrowing costs with longer repayment schedules because the Small Business Administration (SBA) guarantees part of the loan. That guarantee gives lenders the confidence to approve applications that would otherwise be too risky.

Loan amounts can go up to $5 million, with terms as long as 25 years depending on the use. In RelFi’s portfolio, SBA loans consistently deliver 40–60 percent lower payments compared to short-term facilities. National approval rates hover between 27 and 33 percent. RelFi’s approval rate on SBA submissions is above 50 percent, which is why this channel has become a cornerstone for owners who can plan ahead.

There are two main SBA programs most business owners use. The SBA 7(a) loan is the most flexible, covering working capital, acquisitions and refinancing. The SBA 504 loan is built for real estate or heavy equipment, offering longer fixed terms and lower rates. To qualify, applicants need a complete package: financial statements, tax returns, a debt schedule and a clear business plan. SBA lenders review credit score, annual revenue, cash flow, collateral and debt service coverage ratio, which usually needs to be at least 1.25x.

Preferred vs. Non-Preferred SBA Lenders:

Not all SBA lenders operate the same way. Non-preferred lenders must send every file to the SBA for sign-off, which can add weeks to the process and increase the chance of delays. Preferred lenders, on the other hand, have full authority to approve loans in-house. That means faster underwriting, fewer bottlenecks and cleaner approvals. At RelFi, we only work with preferred SBA lenders because speed and certainty matter. In practice, this can cut weeks or months off closing timelines and make the difference between landing the deal or missing it.

A physician group in St. Petersburg, FL secured a $2.47 million SBA 7(a) loan to acquire a second practice and finance renovations. About $1.8 million covered the purchase and $670,000 funded upgrades, including exam rooms and digital imaging equipment. Their monthly payment of $32,300 fit comfortably within projected cash flow.

In Tacoma, WA a home goods retailer consolidated three costly facilities — a $215,000 line of credit from a regional bank, a $95,000 MCA and a $165,000 short-term loan — into one $475,000 SBA 7(a) loan. The 10-year structure at single-digit interest dropped their monthly obligation by 44 percent and freed $36,200 for inventory and marketing.

A logistics company in southern NJ used an SBA 504 loan to purchase a $4.1 million warehouse. The fixed 20-year rate locked in stability and gave them predictable payments across market cycles.

Key features:

- Loan amounts up to $5 million

- Repayment terms up to 25 years

- Lower cost than most online financing options

- May need collateral, personal guarantees and DSCR of 1.25x minimum

SBA financing takes time. Approvals often stretch 30 to 90 days and documentation must be complete from the start. Business owners also need to factor in guarantee fees, packaging costs and closing charges. These loans aren’t built for emergencies. They’re designed for businesses that can plan ahead and want the most affordable terms available.

SBA loans were created to give small businesses access to financing they might not qualify for under strict bank standards. With the right preparation, clean financials and repayment schedules that match revenue cycles, these loans deliver long-term stability. For the right companies, SBA lenders become true growth partners.

3. USDA Loans

USDA programs work a lot like SBA programs but with a sharper mission. Through the USDA’s Business & Industry (B&I) program, they funnel long-term capital into rural areas to drive job creation and strengthen local economies.

Loan amounts can run as high as $25 million, with terms of 7 years for working capital, 15 years for equipment and up to 30 years for real estate. At RelFi, most approvals fall between $1,000,000 and $10 million, the sweet spot that funds real expansion without crushing repayment schedules. Rates usually range from the mid-6s to the low-9s. Real estate projects tend to earn the best pricing closer to 6 percent, equipment loans often fall in the 7 to 8 percent range and working capital usually sits at the higher end.

At RelFi, we’ve funded dozens of USDA projects across the Midwest and South. That includes grain dryers in Michigan, co-packing facilities in Missouri and cold storage expansions in Arkansas and Georgia. On average, USDA approvals in our book take 50 to 60 days. Our approval rate consistently tops 50 percent, compared to a national average of just 35 to 40 percent for rural-focused SBA loans.

The USDA doesn’t lend directly. Instead, community banks and regional credit unions originate the loans while the USDA provides a partial guarantee. A complete application package includes:

- Financial statements

- Business plan

- Collateral schedules

- Proof of rural eligibility (towns or counties under 50,000 people)

A meat processing facility in Dawson County, Nebraska needed expansion capital but wasn’t sure which direction to take. RelFi recommended a USDA loan through a preferred partner lender because the business was based in a qualifying rural market. The package came together at $3.2 million: about $2.5 million for new construction and equipment on a 20-year term and $700,000 in working capital on a shorter 7-year schedule. Together, the blended structure kept total payments manageable a month and gave the business owner room to hire 38 new workers ahead of the fall cattle processing season.

We helped an Eastern-Kentucky timber mill borrow $6.4 million to modernize equipment through a USDA program. The upgrades lifted output capacity by nearly 30 percent in board feet per week. With a 15-year repayment schedule, the mill stabilized costs while scaling operations to meet rising demand.

Key features:

- Loan amounts up to $25 million, with typical RelFi approvals between $1.000,000 and $10 million

- Terms of 7 years for working capital, 15 years for equipment and up to 30 years for real estate

- Interest rates usually mid-6 to low-9 percent, with real estate projects at the lower end

- Affordable long-term financing through rural-focused lenders

- Eligibility limited to areas under 50,000 in population

- Equity requirements: 10–20 percent for existing companies, 20 percent or more for start-ups or energy projects

- Lenders also expect equity contributions and they place heavy weight on FICO score and cash flow. Strong business assets like equipment and real estate often tip the balance toward approval.

These loans take time. Approvals often stretch 60 days plus closing and documentation has to be airtight: financials, collateral schedules, job creation projections and proof of rural eligibility. Lenders familiar with both SBA and USDA programs move faster and help applicants avoid the common pitfalls that slow down less experienced providers.

For rural enterprises, USDA financing fills a gap that other business financing options rarely address. It enables project-scale investments such as new facilities, specialized equipment and long-term infrastructure without forcing repayment terms that crush cash flow. At RelFi, we’ve seen USDA loans turn local operators into regional anchors and give them the capital runway to compete nationally.

4. Business Lines of Credit (LOC)

A business line of credit works like a revolving account. You’re approved for a limit — anywhere from $100,000 to $10 million — and you only draw what you need. Interest applies to the balance you use and once it’s repaid, the credit becomes available again. The revolving structure means your capacity resets every time you pay it down.

At RelFi, most approvals land between $100,000 and $1 million. We’ve funded more than 600 lines of credit in the last decade, making it one of the most common tools we set up for business owners who need day-to-day flexibility.

Most providers ask for a short application, recent bank statements and proof of steady revenue. Unlike a fixed small business loan, payments adjust based on how much you draw. Rates vary: banks and credit unions often price at Prime plus 2–4 percent, while online lenders run from 10 to 24 percent. Smaller LOCs are often unsecured, but higher limits usually require collateral or a personal guarantee. Many lines also include draw fees or annual maintenance charges, so it’s important to confirm terms before signing.

We helped an e-commerce company in Boulder, Colorado was approved for a $450,000 line of credit. In November, they drew $180,000 for holiday ads and repaid it in January, restoring the full limit for spring campaigns.

A restaurant group in Orlando secured a $750,000 LOC from a regional bank with to bridge payroll during slow months. The revolving structure let them borrow and repay three separate times in a year without having to reapply.

RelFi helped a home services contractor in Ohio qualify for a $325,000 LOC through an online lender. Their rate was higher than the competing bank offer they had but the fast approval and funding kept $900,000 in projects on schedule while receivables cleared.

A line of credit is designed for working capital needs like payroll, vendor payments, or uneven receivables. It’s not the right tool for one-time, large-scale investments. For example, if you need $250,000 upfront for a warehouse purchase, a term loan or SBA loan is a better fit. Variable rates are another consideration: when the Fed raises rates, your repayment costs rise too.

A business line of credit acts as a financial safety net. When used responsibly, it helps stabilize operations and protect liquidity. Companies with consistent revenue, solid FICO scores and a repayment history of clean exits qualify for higher limits and better terms over time. For many business owners, it’s the most practical financing option to balance day-to-day operations.

5. Equipment Financing

Equipment financing allows business owners to acquire machinery, vehicles, or technology without draining reserves. The equipment itself secures the loan, which speeds up approval and often makes it easier than qualifying for unsecured business loans. Typical amounts range from $100,000 for a fleet work truck or upgraded delivery van to several million for large-scale manufacturing lines.

At RelFi, most equipment loans we fund fall between $100,000 and $2,500,000, with repayment terms designed to match the useful life of the asset. Rates generally run from 7 to 12 percent, depending on FICO score, collateral strength and industry. Approvals are also fast compared to SBA or bank programs, most close within 3 to 7 business days once documentation is in order. Industries like construction, logistics and healthcare tend to receive the most favorable equipment financing rates because their assets hold strong resale value and steady income streams. For example, construction equipment like excavators and cranes, logistics fleets like box trucks and semis and healthcare equipment such as MRI machines and dental chairs all retain value and can be liquidated if needed, which lowers lender risk.

Business owners complete a streamlined application with details on the equipment, recent financials and proof of annual revenue. Because the asset serves as collateral, lenders place less emphasis on outside guarantees. Terms usually run two to seven years and repayment is typically fixed, making budgeting predictable.

RelFi helped a construction firm in Lubbock, TX finance a $425,000 excavator over five years. Monthly payments of about $9,000 let them take on larger contracts immediately and the equipment itself secured the obligation. Once the loan was paid off, they owned the asset outright.

A printing company in East-Central Illinois leased $900,000 in new presses. Instead of a loan, we helped them secure a lease with a seven-year term. Payments were slightly higher than a loan would have been, but the lease allowed easier upgrades when the technology cycle shifted. Output rose by 22 percent and costs stayed predictable.

A food distributor in Atlanta financed three 26-foot refrigerated box trucks for $420,000 with a trusted lender we work with. The added fleet kept perishable inventory moving year-round and helped them secure $1.3 million in new contracts within 12 months.

Key features:

- Equipment secures the loan, reducing lender risk

- Predictable repayment schedules

- Terms usually match the useful life of the asset

- Approval possible even with limited operating history

- Potential Section 179 tax benefits, allowing accelerated depreciation in the year of purchase

Payments remain due even if the equipment becomes outdated or breaks down. Down payments typically run 5 to 20 percent and the total cost can exceed a cash purchase once financing charges are added. Some providers also require personal guarantees, which should be reviewed carefully before signing. Fees like draw charges or documentation costs may apply, though amounts vary.

Unlike a business line of credit built for recurring working capital, equipment loans are designed for one-time, revenue-producing purchases. Trying to cover a $300,000 excavator with short-term credit would strain liquidity almost immediately. A dedicated equipment financing structure spreads payments over the asset’s useful life and ties costs to the revenue it generates.

For many businesses, equipment is the growth engine. Financing protects reserves, funds expansion and ensures you don’t tie up every available dollar in a single purchase. When structured properly, the cash flow generated by the asset outweighs the cost of capital — turning debt into a growth tool instead of a burden.

6. Revenue-Based Financing

Revenue-based financing (RBF) provides a lump sum of capital in exchange for a percentage of future sales until a set amount is repaid. Unlike a fixed small business loan with monthly installments, repayment moves with your revenue — higher in strong months, lighter in slow ones.

In RelFi’s portfolio, RBF approvals typically fall between $100,000 and $5,000,000. SaaS, e-commerce and subscription-based businesses are the best fit because deposits are steady and predictable. Providers usually want to see at least $50,000 in monthly recurring revenue before they’ll approve and most deals close in 24 to 72 hours once records are verified.

Applicants share recent bank statements and financials. Funding is capped at a multiple of monthly revenue. For example, a company earning $100,000 per month might qualify for $200,000, with repayment set at 5 to 10 percent of sales until the target payback (often $260,000) is reached.

We helped a SaaS company in Austin secure $250,000 in RBF with a 6 percent revenue share. In strong months, payments climbed to $18,000; in slower months, they dropped to $12,000. The company cleared repayment in 18 months and grew ARR by more than $1.1 million during the term.

RelFi helped an e-commerce apparel brand in Venice Beach, CA borrow $400,000 against online sales. Their repayment share averaged 9 percent of deposits, flexing with seasonal swings. The capital let them double ad spend before Black Friday and pay off the facility in just 14 months.

- Key features:

- Repayment tied directly to sales performance

- No fixed term; ends once the set multiple is reached

- Easier approval if revenue is strong, even with weaker credit scores

- Works best for subscription, SaaS, or recurring revenue models

- Typically requires $50K+ in monthly recurring revenue

- Approvals often close in 24 to 72 hours

Revenue-based financing is not low-cost capital. Total repayment typically equals 1.3 to 1.6 times the original amount, making it more expensive than SBA loans or traditional bank financing. It also demands reliable, trackable sales. Companies with unpredictable revenue cycles often struggle, since payments rise sharply in strong months and only ease slightly in weaker ones.

Compared to a merchant cash advance, which also takes a slice of sales, RBF is usually more flexible and better suited for growth-focused companies with recurring deposits. And unlike equity financing, RBF preserves ownership so founders don’t have to give up shares or control to access capital. For one-time needs like equipment or real estate, however, an SBA loan or term loan is often the smarter, lower-cost choice.

Revenue-based financing sits in the middle ground: fast access to growth capital without the rigidity of fixed monthly payments. For businesses in rapid growth mode, the flexibility often outweighs the expense especially when revenue scales quickly and repayment finishes ahead of schedule.

7. Invoice Factoring & Accounts Receivable (AR) Financing

Most business owners face the same crunch: customers pay on 30, 60, or even 90-day terms while payroll and vendors need cash today. Receivables financing bridges the gap. The two main structures are invoice factoring and AR financing. They look similar, but the mechanics and who they work best for are different.

How Invoice Factoring Works

Invoice factoring means selling your receivables. A business submits unpaid invoices to a factoring company, which advances 70 to 90 percent of the value upfront. When the customer pays, the provider releases the balance minus fees. Approval is based more on the client’s creditworthiness than the business itself, which makes factoring accessible to younger companies or those with uneven credit history.

A staffing agency in Forth Worth with $400,000 in net-60 invoices factored them to cover payroll. Within 48 hours, we helped them get $320,000 upfront. When the client paid in full, the factor released the balance minus a 3 percent fee. The structure kept payroll on track without waiting two months for collections.

- Typical approval timeline: 24–48 hours

- Common industries: staffing, trucking/logistics, construction subcontractors

- Typical fee range: 2–4% of invoice value

- Invoice size sweet spot: $25,000 to $1 million per client invoice

- Recourse vs. non-recourse: Most factoring is recourse, meaning the business must buy back unpaid invoices. Non-recourse shifts risk to the factor but comes with higher fees.

How AR Financing Works

AR financing is different. Instead of selling invoices, the business uses them as collateral for a revolving line or advance. The lender advances 70 to 90 percent of receivables upfront and releases the balance once customers pay. The key difference is that collections remain in-house, preserving customer relationships.

A manufacturer near Cleveland with $900,000 in invoices due within 60 days secured a $750,000 AR financing facility with our assistance. Customers paid the company directly and once balances cleared the lender released the remainder minus fees. The setup gave the manufacturer stable cash flow while maintaining client control.

- Typical approval timeline: 3–5 business days

- Common industries: mid-market manufacturing, wholesale distribution, professional services

- Typical fee range: 1–3% of invoice value

- Invoice size sweet spot: $50,000 to $5 million across a portfolio of receivables

Key Features (Shared Across Both)

- Advances of 70–90% of invoice value

- Balance released after customer payment, minus fees

- Faster access to capital than most business loans

- Eligibility tied primarily to client creditworthiness, not the business itself

Factoring: Provider collects directly from customers (recourse or non-recourse)

AR Financing: Business keeps control of collections, receivables pledged as collateral

Factoring is transparent. Customers know their invoices have been sold, which can affect relationships. AR financing is usually confidential but may involve audits, reporting requirements or liens on receivables. Fees can also add up if invoices are slow to clear. Factoring tends to be more expensive per invoice, while AR financing is more cost-efficient for companies with larger receivable bases.

Both structures convert unpaid invoices into working capital. The right choice depends on priorities. Factoring works best for younger or fast-growing businesses that value speed and do not mind customers seeing the arrangement. AR financing fits established B2B companies that want confidentiality and lower long-term costs.

At RelFi, we have funded everything from staffing firms in Texas bridging payroll with factoring to Midwest manufacturers stabilizing vendor payments through AR financing. Both tools serve the same purpose: smoothing cash flow when customer payments lag so owners can keep growth moving.

8. Asset-Based Lending (ABL)

Asset-based lending lets businesses turn receivables, equipment, or inventory into liquidity. The borrowing base is tied directly to the value of those assets, which makes ABL a strong fit for companies that may not qualify for unsecured loans but can show solid collateral on their books.

At RelFi, ABL facilities typically run from $1 million to $20 million. Most approvals take two to three weeks depending on the size and complexity of the collateral pool. Industries with consistent receivables and tangible assets such as manufacturing, wholesale distribution, food and beverage and transportation usually qualify for the best rates and advance levels.

Borrowers provide a detailed schedule of assets. Lenders then apply advance rates by category: receivables at 75 to 85 percent, equipment at 50 to 65 percent and inventory often at 40 to 60 percent. The approved facility can be structured as a revolving line backed by receivables or as a term facility secured by equipment and inventory. In ABL, the focus is on collateral and liquidity rather than FICO or operating history.

A Chicago-area wholesaler pledged $5 million in receivables and $2 million in inventory to secure a $4 million ABL facility. RelFi worked with the lender and sponsor to structure the deal so the line provided steady liquidity for vendor purchases while customer payments cleared. As invoices were collected, the balance automatically paid down and availability was restored, keeping the company’s working capital cycle intact and giving them confidence to scale.

Key features:

- Credit secured by receivables, equipment, or inventory

- Advance rates typically 50–85 percent depending on asset class

- Facilities can be revolving (receivables-driven) or term-based (equipment/inventory)

- Approval relies more on collateral than on credit score

ABL facilities often require detailed reporting, periodic audits and third-party appraisals of pledged assets. Borrowing limits move with collateral values, which means availability can shrink during slower months. Many lenders also file a lien across receivables, inventory and equipment, limiting your ability to secure other financing. Business owners should always confirm whether personal guarantees are required and how the borrowing base will be calculated.

Asset-based lending converts illiquid resources into usable capital. For companies with strong receivables or inventory but limited access to unsecured credit, ABL offers a flexible structure that grows with the business. When designed correctly, it delivers recurring liquidity without sacrificing long-term stability, giving companies the runway to expand while still meeting daily obligations.

9. Merchant Cash Advances (MCA)

A merchant cash advance is not a loan. It provides an upfront lump sum in exchange for a fixed share of future sales. Approvals are rapid, sometimes within hours and funding often lands in 24 hours or less. Approvals can reach up to $5 million depending on sales volume. Instead of an interest rate, MCAs use a factor rate. At a 1.25 factor, for example, a $100,000 advance requires $125,000 to be repaid.

At RelFi, MCA approvals usually fall between $10,000 and $1,000,000 with approval rates above 80 percent. Restaurants, retail operators, transportation companies and seasonal businesses lean on them most because daily or weekly deposits align naturally with repayment schedules. Industry-wide, providers often approve businesses with just $20,000 in monthly revenue. At RelFi, we set the bar closer to $50,000 to ensure repayment capacity and protect owners from getting stuck in cycles they can’t sustain.

Funders review recent bank statements, background and annual revenue trends. Sales volume and deposit consistency carry more weight than personal FICO scores or collateral. Repayments are taken automatically as a percentage of deposits, usually 10 to 20 percent on a daily or weekly basis. Strong sales accelerate repayment while slower periods extend the timeline.

RelFi helped a restaurant group in Bergen county, NJ with $450,000 in steady monthly deposits lock in a $350,000 MCA at a 1.28 factor rate. Weekly ACH withdrawals of about $12,000 cleared the balance in around nine months while funding payroll and a new delivery program that added $1.1 million in annual revenue.

We helped a long time client, a regional trucking company in the Tampa Bay Area, with a $600,000 MCA. The advance bridged rising fuel costs and payroll while waiting on a $2.5 million receivables cycle. Once invoices cleared, the client was able to take advantage of a generous pre-payment discount we were able to negotiate with the funder. Because we had a clear exit plan with our client, they not only bridged payroll and fuel but also shaved thousands off the total cost through the pre-payment discount.

A boutique apparel chain in the Bay Area secured a $250,000 MCA with RelFi ahead of the holiday season to stock premium inventory. Seasonal sales topped $1.1 million, more than four times the total cost of capital and the advanced was paid back ahead of schedule.

Key features:

- Same-day or next-day funding available

- Advance amounts sized to recent monthly deposits

- Repayment tied to 10–20% of daily or weekly revenue

- No traditional collateral required

- High approval rates (80%+ with RelFi)

- Minimum monthly revenue: $20K industry standard; $50K minimum monthly revenue at RelFi

MCAs deliver speed, but that speed comes at a price. A 1.35 factor rate adds $35,000 in fees to a $100,000 advance. Daily or weekly withdrawals can drain liquidity if revenue dips and short repayment windows leave little room for error. Stacking multiple MCAs (taking out a new advance before the first is paid off) is one of the fastest ways to hurt cash flow with more deposits going to repayment than to operations. Many MCA contracts also include a UCC filing that locks up your assets and blocks access to future credit until the advance is cleared. Terms should be reviewed with your RelFi team before signing.

An MCA is built for situations where time is the critical factor. If the same restaurant had 30 to 45 days to wait for an SBA Express loan, its repayment might have been closer to $2,200 per month at a fraction of the cost. But when payroll is due Friday and invoices won’t clear until next month, an MCA may be the only option fast enough to keep the doors open.

Merchant cash advances provide access when lenders cannot move quickly enough. For many owners, they serve as a bridge to cover payroll, fuel growth, or capture short-term opportunities. The smartest play is to treat an MCA as a temporary fix while preparing to refinance into lower-cost capital. At RelFi, we’ve helped disciplined clients roll MCAs into term loans or SBA facilities within months, turning a costly short-term bridge into a stepping stone toward stability.

Over the past few years, we’ve watched hundreds of clients who normally relied on traditional bank products get their credit lines cut back with little warning. Many of them ended up in the MCA market simply because they needed speed and flexibility. That influx of stronger, larger borrowers has changed the MCA landscape. Pricing has come down as funders adapt to the lower risk profile of larger, better-capitalized companies. RelFi has been at the center of that shift, structuring MCA deals in the teens for qualified businesses and showing how this product can serve as a practical, cost-efficient short-term solution for established businesses.

10. Term Loans

A business term loan is the most traditional financing structure. You borrow a set amount upfront, often from $100,000 to several million and repay it on a fixed schedule. Terms typically run one to ten years, with pricing based on credit profile, collateral and lender type.

In RelFi’s portfolio, term loans usually range from $100,000 to $2 million. Approvals are stricter than for short-term products, but once funded, they deliver some of the most stable and affordable financing available. Timelines often run two to four weeks from application to closing, depending on deal size and documentation readiness.

Borrowers provide recent financials and tax returns. Lenders review FICO scores, debt service coverage ratios (1.25x minimum is common) and collateral. Many banks also prefer to see at least $1 million in annual revenue before underwriting larger facilities. Once approved, the loan is disbursed in full and repaid through structured monthly installments.

Rates may be fixed or variable. Fixed rates lock in predictability, while variable rates may start lower but adjust with the market. Banks often favor fixed-rate structures while online providers tend to lean variable.

A metal fabrication shop in the greater Pittsburgh area secured a $2.5 million term loan at an 8 percent fixed rate over seven years. RelFi worked with the lender to structure payments around steady receivables, keeping monthly debt service predictable at just under $40,000. The financing gave the company the confidence to expand capacity and bid on larger municipal contracts without straining cash flow.

A freight carrier in Arkansas borrowed $6.8 million for fleet upgrades on a 10-year schedule. RelFi positioned the deal with a bank partner who understood their receivables cycle, ensuring fixed debt service that matched contract payments. The structure stabilized costs while enabling the company to add 18 new tractors and expand regional routes.

A Dallas–Fort Worth dental group consolidated $8.5 million in higher-cost short-term debt into a single 10-year term loan. RelFi partnered with the group’s private equity sponsor to restructure the balance sheet and secure more favorable terms. The refinancing cut debt service by 29 percent, freeing over $118,000 per month in liquidity. That working capital went directly into expansion, funding three new clinic openings across North Texas and boosting EBITDA growth that positions the platform for future add-on acquisitions.

Key features:

- Fixed borrowing amount with structured repayment

- Terms from 1 to 10 years

- Approvals typically in 2–4 weeks

- Available through banks, fintechs and specialty finance firms

- Pricing usually Prime + 2 to 6 percent

- Collateral or personal guarantees often required for larger amounts

- Fixed or variable rate options depending on lender

- SBA 7(a) loans often serve as the longer-term alternative (up to 25 years)

Term loans come with stricter underwriting than working capital loans or merchant cash advances. Lenders look for strong financials, clean credit and consistent annual revenue. Borrowers should also plan for closing costs, origination fees and possible prepayment penalties, often 1–3 percent if repaid within the first two years and broker fees. Most facilities include covenants, such as maintaining a DSCR of 1.25x or higher, providing quarterly or annual financials and avoiding additional debt without consent. Fixed rates protect against rising markets but limit upside if rates drop unless refinanced. UCC filings are standard and can restrict access to other credit facilities until satisfied.

Term loans make the most sense when you know the exact amount of capital required and can commit to a fixed repayment schedule. They are ideal for warehouse purchases, major equipment upgrades, or multi-year projects where stability matters. Revolving facilities like a business line of credit fit better for ongoing needs, while SBA 7(a) loans often provide longer horizons and lower costs for borrowers who qualify. For short-term liquidity gaps, a term loan can feel rigid compared to faster, more flexible products.

Term loans give small business owners confidence to take on big, multi-year moves by balancing large capital needs with predictable repayment. When structured properly, the return on investment from expansion, staffing, or equipment upgrades typically outweighs the cost of capital. At RelFi, we’ve seen well-timed term loans not only fuel growth but also preserve access to future credit, turning a single facility into the foundation for long-term growth.

11. Commercial Real Estate (CRE) Financing

Commercial real estate (CRE) financing lets companies purchase or upgrade property without draining reserves. Warehouses, office buildings, retail locations and specialized facilities like medical or food processing plants all qualify. Unlike short-term funding, CRE loans are tied to the property itself and typically carry long repayment terms.

At RelFi, CRE facilities usually range from $1 million to $10 million. Closings often take 60 to 90 days, longer if environmental reviews or zoning approvals are involved. Loan-to-value (LTV) ratios typically fall between 70–80% so borrowers should plan on a 20–30% down payment. Lenders also apply debt yield requirements of 8–10% to make sure the property generates enough income to support the loan.

CRE loans are offered by banks, private lenders and commercial finance firms. Loan amounts depend on the appraised property value and the borrower’s repayment capacity. Terms run 5 to 25 years, with amortization schedules often extending longer than the actual term, for example, a 20-year amortization with a 10-year balloon. This keeps monthly payments lower but requires refinancing or payoff before maturity.

Rates can be fixed or variable. Banks typically land in the 6–9% range while private lenders and investors price higher in exchange for speed and flexibility. Owner-occupied properties usually qualify for the best pricing, while investment properties carry higher rates and stricter underwriting. Most loans are recourse, requiring a personal guarantee, though non-recourse terms may be available for stabilized, income-producing properties.

A co-packing bakery in the Sacramento area acquired a $6.8 million facility with RelFi structuring the CRE loan. A 25-year amortization on a fixed rate kept monthly payments manageable while expanded capacity doubled output and positioned the company for new distribution contracts.

RelFi helped a trucking business in the Houston metro refinance a $12.4 million warehouse into a blended 20-year structure with a 10-year term. We worked with the lender to cut monthly debt service by nearly $58,000. The only tradeoff was a balloon at maturity but the refinance gave them runway to expand their fleet by 30%.

A multi-location medical group secured $10.2 million to acquire and renovate a flagship clinic. RelFi structured the deal with $5.1M in conventional bank financing, $4.1M through an SBA 504 debenture and $1.0M in equity. The blended 23-year fixed repayment came in well below market, locking in predictable long-term costs.

The project funded the buildout of 15 new exam rooms and expanded imaging capacity, including upgraded MRI and digital X-ray equipment. Patient throughput rose by more than 35% within the first year, turning the flagship into a regional anchor for growth.

- LTV ratios usually 70–80%

- Down payments typically 20–30%

- Terms of 5–25 years, often with amortizations longer than the actual loan term

- Fixed or variable rates depending on lender and property type

- Debt yield requirements often 8–10%

- Owner-occupied properties get the best pricing; investment properties pay more

- Rates typically 6–9% with banks/credit unions; higher with private lenders

- Most loans are recourse with personal guarantees, though non-recourse is available on strong, stabilized properties

CRE financing moves slowly. From appraisal to underwriting to closing, expect 60–90 days. Borrowers should also keep an eye on:

- Balloon structures: Longer amortizations than loan terms create refinance risk.

- Prepayment penalties: Yield maintenance or step-down structures are common in the first 3–5 years.

- Recourse vs. non-recourse: Most lenders require personal guarantees, but stabilized income properties may qualify for non-recourse.

- Covenants: Minimum DSCR (often 1.25x), quarterly reporting, or restrictions on new debt are standard.

- Debt yield tests: Many lenders require 8–10%, which limits leverage on lower-yielding assets.

CRE financing really shines when the goal is long-term stability: buying a warehouse instead of renting, refinancing at lower rates, or renovating to expand capacity. SBA 504 loans often pair with CRE deals to stretch amortizations and lower effective rates for owner-occupied properties.

Owning property locks in occupancy costs and builds equity. While the process is slower and more complex than short-term funding, CRE financing gives businesses control over their future space, protection against rent hikes and a stake in property appreciation. At RelFi, we’ve taken an active role in structuring CRE loans that meet tough eligibility requirements, coordinating to create long-term stability.

We’ve seen these structures become the cornerstone of growth strategies, giving clients operational stability and helping build generational wealth. RelFi partners with member-FDIC insured banks where approvals are backed by real institutions. That combination of security and flexibility allows us to negotiate terms that stand up over the long haul.

12. Hard Money Loans

Hard money loans are short-term facilities secured primarily by real estate. Unlike SBA loans or bank programs, approval depends less on credit history and more on the property being pledged. Because providers take on more risk and move quickly, pricing is higher — but the tradeoff is funding that can arrive in days instead of months.

In RelFi’s experience, hard money approvals typically range from $250,000 to $5 million, with closings in as little as 5–10 business days once title and collateral checks are complete. They’re most common in construction, investment acquisitions and fix-and-flip projects where timing is critical and traditional underwriting is too slow.

A hard money lender structures the deal almost entirely around collateral value and exit strategy. Borrowers usually receive 60–80% of the property’s value (LTV). Terms are short, typically 6 months to 3 years. Underwriting focuses less on income history and more on whether repayment will come from a refinance, a sale, or another defined cash event.

Real Examples from RelFi:

A developer in the Hudson Valley secured a $500,000 hard money loan against a commercial property to cover materials and labor while waiting on a delayed refinance. RelFi moved the deal from application to funding in just 7 days, keeping the project on schedule and payroll uninterrupted.

An investor in Orange County purchased a $1.8 million multifamily property using a $1.2 million hard money facility. The 12-month structure gave time to renovate and lease units before refinancing into a long-term 25-year permanent loan.

A hotel operator in the Fort Myers area used a $2.4 million bridge loan to acquire and stabilize a property ahead of peak season. Once occupancy records showed steady income, RelFi guided the borrower into a permanent SBA package, locking in lower cost and longer terms.

Key features:

- Approval based primarily on collateral value, not revenue or FICO score

- Typical loan amounts: $250K–$5M (60–80% LTV)

- Terms: 6 months to 3 years

- Funding speed: 5–10 business days

- Origination fees: usually 2–4 points (higher for riskier assets)

- Minimal documentation compared to traditional bank underwriting

Hard money loans are among the most expensive financing options. Rates often exceed 10–15%, plus origination and servicing fees. Many contracts include cross-collateralization, where multiple properties are pledged to secure a single loan, giving lenders rights across your portfolio if repayment falters. In some cases, lenders will also require personal property such as equipment or business assets in addition to real estate. Most facilities are full-recourse with personal guarantees, though some non-recourse deals exist for lower-LTV, stabilized investment properties. Because repayment windows are short, borrowers need a clear exit plan, refinancing, sale, or payoff from another cash event.

Hard money trades cost for speed. If you can wait 60–90 days for a bank or SBA loan, you’ll usually secure far better pricing. But when a deal requires funding in under two weeks, such as acquiring property before a competitor or bridging construction costs, hard money is often the only tool fast enough to keep the opportunity alive.

For businesses tied to real estate, these loans provide speed and flexibility that other lenders simply cannot match on a short timeline. They should always be viewed as a bridge, not a permanent solution. Used strategically, hard money loans keep projects moving and open doors to opportunities that conventional programs miss. At RelFi, we’ve seen dozens of clients turn well-executed hard money strategies into long-term stability by refinancing into SBA or CRE facilities once the dust settles.

UCC Filings

Most forms of business financing come with a UCC filing attached. UCC stands for Uniform Commercial Code and the filing is a public notice that a lender has rights over certain assets until the debt is repaid. Think of it as a marker in the public record that says, “this lender has first claim if repayment fails.”

There are two common types. A UCC-1 blanket lien covers all business assets including receivables, equipment and inventory. A specific collateral lien only covers one item, such as a truck in an equipment financing deal. SBA loans and most traditional bank products typically use blanket liens while asset-based or equipment lenders often file against specific assets.

Why does this matter? Because UCC filings affect your ability to borrow again. If another lender sees a lien on file they may hesitate to issue new credit unless the original lender agrees to share or release it. That is why payoff letters and debt schedules are so important. Cleaning up old liens can speed up future approvals.

UCC filings are a standard part of commercial lending. The key is knowing what is filed, who filed it and making sure liens are released once debts are paid. Staying on top of your UCC record prevents unnecessary delays when you need new funding.

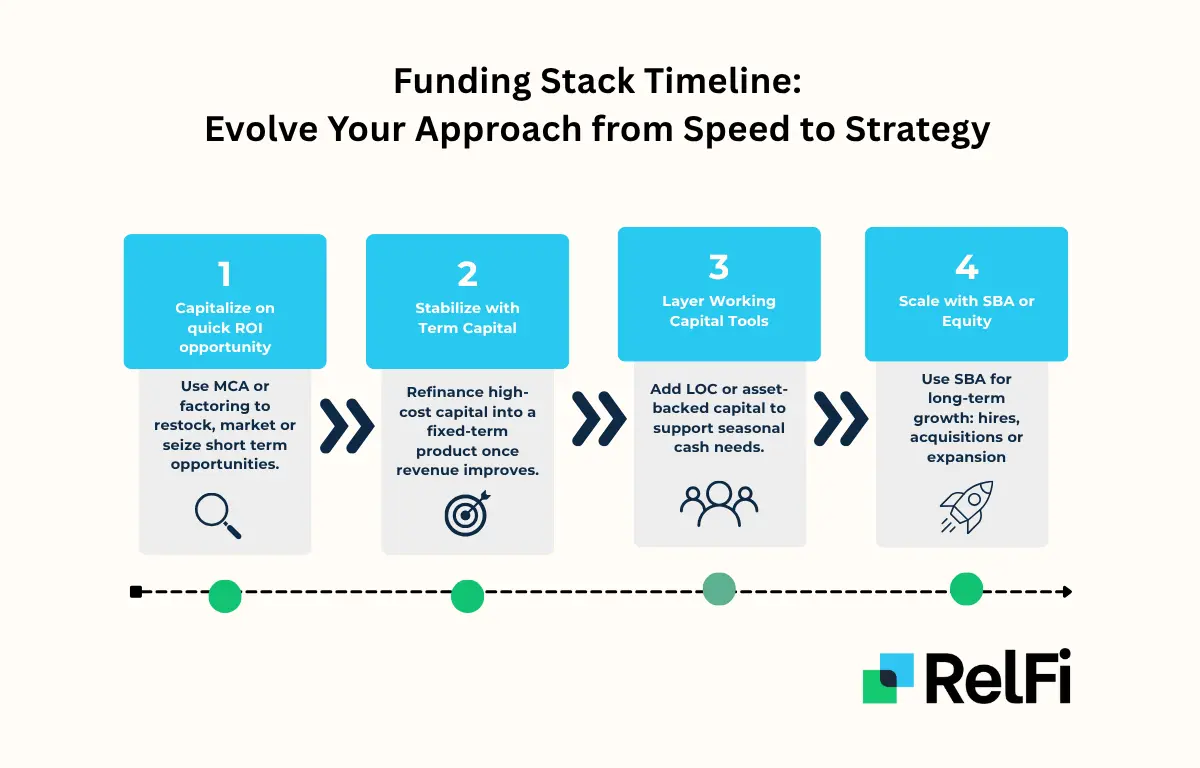

Building a Smart Funding Path

The most important insight from all these financing options is that they work best when structured to complement each other. Some owners borrow once for a single project and that is enough. Others build a capital path where one facility supports the next stage of growth. After funding thousands of deals, we have seen the same pattern repeat: businesses that plan how tools fit together lower their costs and open bigger opportunities, while those that grab products at random often end up stuck with expensive repayment cycles.

Short-term tools such as working capital loans, MCAs and business lines of credit cover immediate needs. They move fast, but the cost is higher and repayment schedules are tighter. These should be treated as bridges, not permanent solutions. Think of them as the tool you reach for when payroll is due Friday or a supplier discount expires tomorrow.

Mid-term solutions such as AR financing and asset-based lending give businesses flexibility while tying repayment to assets that generate revenue. These are especially effective when growth depends on tangible resources like receivables, inventory, or equipment. In RelFi’s portfolio, companies that graduate into ABL after proving themselves with AR facilities often cut their borrowing costs by 30 to 40 percent.

Long-term financing including SBA loans, term loans, USDA programs and commercial real estate financing is where lasting stability comes from. These come with stricter requirements, more collateral and cleaner financials, but the tradeoff is larger approvals, lower rates and extended repayment schedules. Hard money loans sit outside this path as a niche tool. They are expensive but sometimes the only way to close a property-backed deal faster than any SBA lender or other lenders can deliver.

RelFi plays an active role in helping clients navigate this path. We map out which products fit their cash flow, when to refinance and how to present qualifications to banks and lenders. That hands-on approach often makes the difference between paying premium pricing and securing bank-guaranteed capital on terms that actually support long-term growth.

Why the Path Matters

A Clearwater-based commercial solar installation business worked with RelFi to cover payroll through a $250,000 working capital loan while waiting on an SBA 7(a) approval. We structured the bridge to match their revenue cycle and when the SBA deal closed 60 days later, they refinanced at less than half the cost.

A Midwest liquor distributor relied on AR financing to cover vendor payments for six months. Once they built repayment history and organized their financials, RelFi helped them secure a $4 million ABL facility tied to receivables and inventory, giving them recurring liquidity at lower cost.

In 2024, RelFi helped a Naples retailer secure a $175,000 MCA to bridge a holiday inventory crunch. Three months later, steady revenue growth allowed them to refinance into a term loan with predictable payments, freeing up cash for expansion instead of daily withdrawals.

What to watch:

- Renewal traps: Too many owners fall into a cycle of renewing short-term facilities or stacking MCAs. Each renewal erodes margins until more cash goes to repayment than to growth. A clean path avoids that spiral.

- Credit profile impact: Sequencing properly also improves credit. Paying down short-term facilities on time, then refinancing into SBA or term loans, strengthens your credit score and DSCR. That opens the door to bank-guaranteed capital at better rates. RelFi takes an central role in mapping this progression so financing builds long-term eligibility instead of dragging it down.

The bottom line:

Capital becomes a growth engine when each step sets you up for the next. The wrong move locks you into expensive repayment cycles, but the right path builds eligibility, strengthens credit history and lowers costs over time.

That is the difference between constantly reacting to shortfalls and building a financial strategy that compounds. Entrepreneurs who treat financing as a system, not just a series of one-off transactions, put themselves in the strongest position to expand, hire and capture opportunities.

Not sure how to structure your own funding path? RelFi helps business owners avoid renewal traps and dead ends by mapping the right plan up front. Let’s chart your next move together → relfi.co/contact

Which Funding Options Make Sense at Each Stage

Funding needs shift as a business grows. The option that works in the first year may be a poor fit five years later. As revenue stabilizes and financial history builds, minimum requirements change and better tools become available. After reviewing more than 50,000 applications, we’ve seen the same progression repeat: survival, expansion, then scale.

Early Stage: Surviving and Proving Demand

In the first year, survival comes before strategy. Liquidity is tight and lenders care more about deposits than profitability. Most owners lean on personal assets, credit cards, or short-term capital just to cover payroll and keep inventory moving.

- Typical revenue: Under $500K annually

- Common options: Credit card stacking, merchant cash advances, revenue-based financing

- Goal: Cover immediate expenses, keep operations alive and build the track record lenders need to see

- Common mistake: Stacking too many short-term products at once, draining cash flow and killing future approvals

RelFi insight: About 70% of startups that secure clean, short-term capital early improve their odds of qualifying for larger facilities within 12 months. We’ve seen it firsthand, founders who start with a small MCA or revenue-based facility and exit cleanly are often able to double or triple approvals the next year.

Building Stage: Expanding and Protecting Liquidity

Once deposits become more predictable, financing shifts from survival to expansion. At this stage, lenders start looking at financial records and annual revenue instead of just raw bank activity. The right mix of flexible tools lets businesses hire, expand marketing and build capacity while smoothing timing gaps between receivables and payables.

- Typical revenue: $500K–$1M annually

- Common options: Working capital loans, business lines of credit (LOC), equipment financing, revenue-based financing, small business loans

- Goal: Hire staff, fund marketing campaigns, expand capacity and protect liquidity

- Common mistake: Leaning only on short-term loans instead of layering in a LOC, which leaves businesses exposed when receivables run late

RelFi insight: Clients who stack only one-off loans often end up scrambling when payables come due. By contrast, businesses that layered a revolving LOC on top of their working capital saw liquidity crunches drop by 40–50%. We’ve seen hundreds of businesses avoid payroll stress entirely just by structuring the right mix of term and revolving capital.

Established Stage: Scaling With Larger, Cheaper Capital

Once revenue is steady and financials are clean, businesses unlock the next tier of financing. This is where long-term tools become available — SBA loans, term loans, asset-based lending and commercial real estate financing. Capital shifts from keeping the lights on to fueling strategy: acquisitions, property purchases and refinancing expensive short-term debt into stable, long-term structures.

- Typical revenue: $1M–$5M+ annually

- Common options: SBA loans, term loans, asset-based lending, commercial real estate financing

- Goal: Buy property, acquire competitors, refinance short-term debt into longer-term stability and lock in financing for the next decade

- Common mistake: Holding onto costly short-term debt too long, which drains margins and delays expansion

RelFi insight: At this stage, repayment history becomes leverage. Clients we’ve guided from short-term facilities into SBA or CRE loans often cut borrowing costs by 50–70% while unlocking 10–20x more capital. We’ve seen businesses in places like the Midwest and Sunbelt turn $500K MCA cycles into $5M+ SBA approvals simply by sequencing correctly and showing lenders clean exits.

Using More Than One Tool

Most businesses don’t stop at one product. They build on financing over time. A merchant cash advance or short-term facility might bridge payroll today then roll into a traditional loan once financials support approval.

The rule of thumb is simple: match the repayment term to the return timeline. Short-term financing fits fast-turn needs like inventory or campaigns while long-term financing is best for property, equipment, or acquisitions.

Think of it as a funding path: start with fast tools to cover immediate needs, then graduate into larger, longer-term structures as stability improves. Businesses that follow a clear path, instead of grabbing whatever is available in the moment, build stronger credit profiles, lower costs over time and unlock bigger opportunities to scale.

How to Think Like a Lender: Credit Score and Eligibility Requirements

Every lender is asking the same question: how am i going to get paid? The product type changes the details, but the fundamentals stay the same. They want deposits they can trust, documented revenue and a repayment plan that makes sense both on paper and in practice.

In RelFi’s experience, the line between approvals and declines almost always comes down to preparation. Owners who understand what underwriters are looking for walk in with leverage. Owners who show up unprepared pay more or worse, leave without funding.

Funding Type | Top Approval Factors |

|---|---|

MCA, revenue based financing | Bank deposits, balances, NSF history |

Small Business Administration (SBA) | FICO, DSCR, profitability, debt schedule |

Equipment Financing | Asset type, asset value, income |

Invoice Factoring, AR Financing | Unpaid invoices, customer payment history |

Asset-Based Lending | Collateral value, lien position |

Lines of Credit | Revenue history, repayment & usage patterns |

Term Loans | FICO, tax returns, cash flow coverage |

Commercial Real Estate (CRE) Financing | Property value, down payment, DSCR |

Hard Money | Collateral value, property appraisal, exit plan |

USDA Loans | Rural location, collateral, business plan |

Core Checks Every Lender Makes

No matter the product, approvals always come back to a few key metrics:

- Income stability: Are deposits consistent, or do balances swing wildly month to month?

- Annual revenue: Is there enough income to support repayment with a cushion left over? Once annual revenue passes $500K, most long-term products start opening up.

- FICO score: Still matters, though the weight depends on the product. Below 600 usually means MCA or revenue-based financing. A score between 650 and 700 opens SBA and term loan lanes, while 700+ unlocks prime pricing.

- Collateral: Assets like real estate, receivables, or equipment that can back the debt if things go wrong.

- DSCR (Debt Service Coverage Ratio): Most lenders want to see at least 1.25x, meaning $1.25 in income for every $1 in debt payments.

- Public records: Recent bankruptcies, tax liens, or judgments can shut off access to most long-term products. In practice, a fresh bankruptcy usually limits options to MCA or revenue-based facilities until two to three years of clean repayment history are established.

Why Structure Matters

Even good businesses get declined when their funding strategy looks messy. Stacking multiple MCAs or mixing repayment schedules that clash is a red flag. Underwriters spot the stress before you even explain it. The strongest applicants show:

- Clean use of funds (one facility for one purpose)

- Steady repayment habits (no bounced debits, no skipped payments)

- Logical sequencing (short-term bridge followed by long-term refinance, not the other way around)

Presenting Your Business Well

Think like the underwriter before you apply. Bring the numbers they want to see, in the format they expect. That means:

- Updated financial statements (P&L, balance sheet, cash flow)

- Consistent information across every application (inconsistencies kill deals fast)

- A clear use-of-funds plan tied directly to ROI

RelFi Insight: After reviewing more than 50,000 applications, we've noticed a pattern: the businesses that get approved are the ones that make it easy for underwriters to say yes. They know their numbers, anticipate the questions and have an exit strategy before they even step into the conversation.

Making Capital Choices

Choosing the right loan or financing tool means looking beyond the headline rate. The structure has to match how your company actually runs. After funding more than 10,000 businesses, we’ve found that three questions separate smart financing decisions from costly ones.

1. What is the money for?

Short-term needs like payroll, vendor payments, or seasonal inventory are best matched with short-term products or a business line of credit. Larger moves such as buying equipment, purchasing property, or acquiring a competitor align better with SBA loans, term loans, or commercial real estate financing.

The distinction matters. Borrow long-term for a short-term gap and you’ll overpay in interest. Borrow short-term for a long-term project and repayment will suffocate your cash flow.

2. How will repayment fit your revenue?

If deposits hit weekly, a weekly schedule can work. If clients pay on 30- or 60-day terms, fixed monthly installments are safer. The principle is simple: money has to come in before it goes out.

RelFi uses repayment modeling to show how each structure plays out against your actual revenue cycle. This is where “cheap on paper” deals are exposed for what they are and sustainable deals stand out.

3. Will this leave room for your next move?

Some facilities come with prepayment penalties or fees that lock you in. Others allow refinancing or early payoff as revenue grows. Planning ahead for SBA refinancing or other bank-backed products can cut costs dramatically and improve your eligibility profile for the next round of capital.

Bottom line: The best choice is not the one with the lowest rate today. It is the one that fits your immediate goal, matches your revenue rhythm and leaves you room to keep building.

Working With Banks, Advisors and Other Funding Partners

Most SMBs use more than one provider over time. Banks, online lenders and advisors each play a different role. Knowing when to work directly with a lender and when to bring in a funding partner can improve both approval odds and pricing.

Banks and FDIC-Insured Lenders

Traditional banks often provide the most competitive interest rates on SBA loans, term loans and commercial real estate financing. But because they’re federally insured, they follow strict underwriting standards. Expect collateral requirements, personal guarantees and higher FICO cutoffs.

Rate differential: Banks and SBA providers usually price in the single digits (7–11%), while online lenders commonly land in the 12–24% range for the same profile. That spread is why businesses that can wait for bank approvals usually save tens of thousands over the life of the loan.

Online Lenders

These platforms move faster and ask for lighter documentation. They weigh recent deposits more than tax history. Costs are higher, but they’re often the most practical source for urgent working capital loans, MCAs or lines of credit.

Pattern we see: Over 80% of RelFi clients who turn to these lenders do it to solve a time problem, payroll due Friday, inventory deal expiring this week, not because they prefer a higher rate.

Advisors and Brokers

Advisors and brokers help compare options and prepare stronger applications. A good broker clarifies tradeoffs, translates repayment into dollars and flags terms that reduce flexibility. The best ones also negotiate with lenders on your behalf.

Typical fee: Brokers usually charge 1–5% of the funded amount, depending on deal size, complexity and the amount of prep and negotiation required.

A financial advisor, by contrast, is usually focused on the bigger picture: tax strategy, wealth planning, or how business debt interacts with personal finances. They’re not a replacement for a funding broker, but they add value when debt decisions ripple into broader strategy.

When to Use Each

- Banks and SBA providers: Best for long-term products, larger amounts and the lowest cost of capital.

- Online lenders: Useful when speed is the priority and working capital is urgent.

- Advisors and brokers: Critical for application prep, lender negotiations and accessing alternatives like venture capital or similar investors.

Every option has its place, but the reality is that most business owners don’t have the time or experience to navigate them alone. That’s where brokers like RelFi become irreplaceable. We take an active role in matching you with the right funding lane, shaping how lenders view your business and negotiating terms that stand up over time. Businesses that combine direct lender relationships with expert broker guidance consistently secure better approvals, lower borrowing costs and avoid the dead ends that stall less-prepared applicants.

Myths and Misconceptions About Business Funding & Using Personal Funds